Florida lawmakers are actively debating significant property tax reforms, with proposals ranging from outright elimination to substantial reductions. This potential overhaul, championed by Governor Ron DeSantis, aims to provide relief to homeowners, particularly seniors on fixed incomes. However, concerns are mounting regarding the impact on essential local government services and the potential need for alternative revenue streams.

Key Takeaways

- Proposals to reduce or eliminate property taxes are gaining traction in the Florida Legislature.

- Governor Ron DeSantis is a strong proponent of property tax relief.

- Local governments warn that significant tax cuts could lead to drastic reductions in public services.

- The "Save Our Homes" amendment, enacted in 1992, has created disparities in tax burdens between long-term and new homeowners.

- Any major changes to property tax laws would likely require voter approval via a constitutional amendment.

The Push for Property Tax Reform

Governor Ron DeSantis has made property tax relief a key priority, advocating for the eventual elimination of these taxes for homeowners. This initiative is fueled by concerns over rising property values and the increasing tax burden on residents. Hillsborough County Commissioner Josh Wostal has publicly supported the governor’s call for eliminating property taxes, suggesting a potential increase in sales tax to compensate for lost revenue. He argues that a portion of current property tax revenue is subsidized by non-residents, benefiting local fixed-income seniors and low-income individuals.

Potential Impact on Local Services

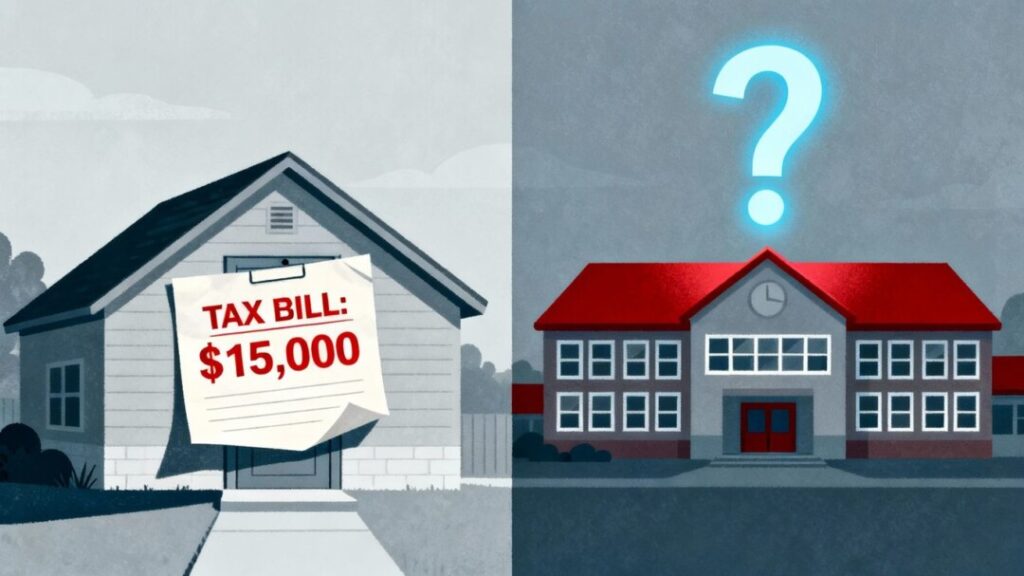

Conversely, local government officials and policy analysts express serious concerns about the feasibility and consequences of drastic property tax cuts. A study by the Florida Policy Institute estimates that eliminating property taxes could cost Florida’s counties, cities, and school districts billions of dollars annually. For instance, Hillsborough County alone could lose approximately $1.47 billion in property tax revenue, which funds critical services like law enforcement, parks, and schools. Officials warn that such a reduction would necessitate either significant cuts to these services, increases in other taxes or fees, or a combination of both.

The "Save Our Homes" Legacy

The ongoing debate also highlights the long-standing effects of the "Save Our Homes" amendment, passed in 1992. This amendment limits annual assessment increases on homestead properties to 3% or the consumer price index, whichever is less. While intended to protect long-term homeowners, it has led to significant disparities in tax bills for similar properties based on ownership duration. Newer homeowners often face substantially higher tax burdens compared to their long-established neighbors, raising questions about equity and affordability, especially for younger generations seeking homeownership.

Path Forward

Any substantial changes to Florida’s property tax structure will likely require voter approval through a constitutional amendment, needing at least 60% support. Lawmakers are exploring various proposals, including phasing out taxes entirely, eliminating them for seniors, or removing all but school-related taxes. Think tanks like Florida TaxWatch are also weighing in with potential plans, though immediate, full elimination is not among their primary recommendations, emphasizing the need for local government involvement in budget planning. The upcoming legislative session and potential ballot initiatives will determine the future of property taxes in the Sunshine State.

Sources

- Save Our Homes makes property tax reform less urgent for some residents, The Bradenton Times.

- Impact on local services if Florida property taxes are cut, WUSF.

- Eliminating property taxes would have cost Tampa Bay billions this year, Axios.

- Proposals come forward as Florida lawmakers set to discuss potential property tax elimination, reduction |

FOX 13 Tampa Bay, FOX 13 Tampa Bay. - Florida lawmakers eye property tax reform, homestead exemption hike, The Business Journals.