Florida’s real estate market is grappling with a challenging confluence of escalating insurance premiums and proposed property tax reforms, creating uncertainty for homeowners and potential buyers alike. Citizens Insurance is actively reducing its policy count, pushing homeowners towards private insurers, often at a higher cost. Simultaneously, legislative proposals aim to significantly alter property tax structures, including potential elimination for seniors, which could reshape the market.

Key Takeaways

- Citizens Insurance is transferring hundreds of thousands of policies to private insurers, leading to increased costs for some homeowners.

- Proposed property tax reforms, including potential elimination for seniors, could significantly impact the housing market.

- High insurance costs and property tax concerns are contributing to a slowdown in the housing market, with increased inventory and fewer sales.

Insurance Market Shifts

Citizens Insurance, the state’s insurer of last resort, is aggressively working to reduce its exposure by moving policies to the private market. This year, approximately 355,000 policies have been transitioned, with a significant portion going to private insurers. While this move aims to stabilize the market and reduce taxpayer risk, it comes with a financial impact for some homeowners. For instance, one homeowner faced an increase of nearly $4,000 annually, a substantial burden for those on fixed incomes. Despite these challenges, market conditions have improved, offering homeowners more options than in previous years, according to the Insurance Information Institute.

Property Tax Reform Proposals

In response to rising property tax burdens, Florida lawmakers have introduced several bills aimed at providing relief. A prominent proposal seeks to eliminate non-school homestead property taxes entirely for seniors. Other proposals include phasing out non-school homestead property taxes over a decade, creating new exemption amounts, and adjusting caps on assessment increases. These measures, if passed and approved by voters, could significantly alter the financial landscape for property owners. However, concerns remain about the potential impact on local government funding and the possibility of shifting tax burdens to lower and middle-income households if sales taxes increase to compensate for lost revenue.

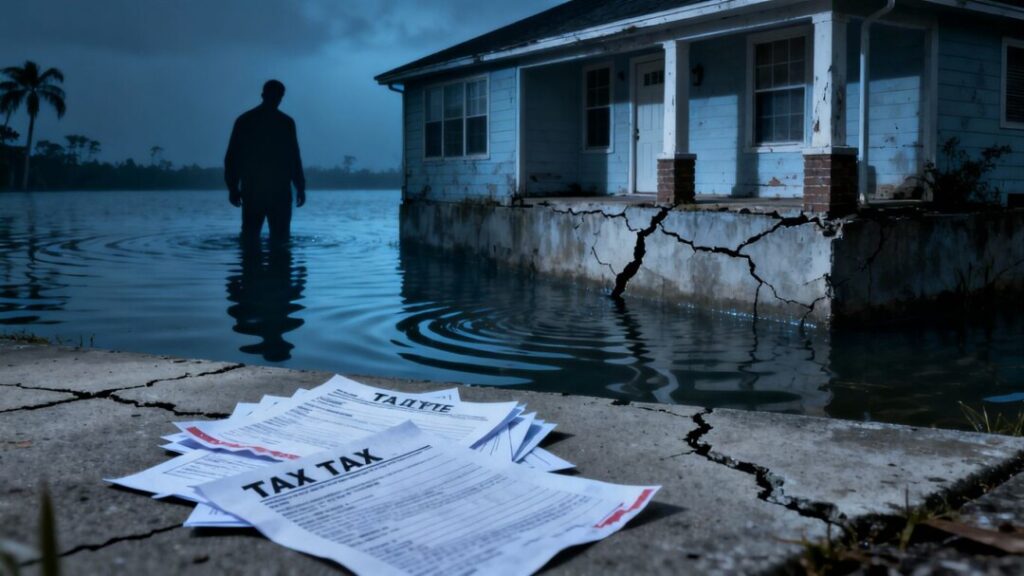

Impact on the Housing Market

The combination of high insurance costs and the uncertainty surrounding property tax reforms is contributing to a slowdown in Florida’s housing market. Homeowners are experiencing difficulty selling properties, with increased inventory and reduced demand in many areas. Some sellers are forced to significantly reduce prices. The rising cost of insurance, exacerbated by hurricane activity, makes Florida one of the most expensive states for home coverage. Furthermore, stricter building inspection laws following the Surfside tragedy have led to costly assessments for condominium owners, further impacting property values and sales. Institutional investors are also reportedly divesting from the market, potentially leading to further price declines.

The ‘Save Our Homes’ Cap Debate

Long-standing property tax measures, such as the "Save Our Homes" amendment that caps annual assessment increases at 3% for homesteaded properties, are also under scrutiny. Critics argue that this cap disproportionately shifts the tax burden to non-homesteaded property owners, including seasonal residents and businesses. This has led to situations where identical homes can have vastly different tax bills. Some real estate professionals believe that eliminating or reforming this cap is crucial for a healthier real estate market, arguing that it currently handcuffs homeowners, deters seasonal residents from becoming permanent ones, and negatively impacts investor cash flow.

Sources

- Citizens Insurance moves 355K Florida policies to private insurers, WPTV.

- Florida Property Tax to Be Eliminated for Seniors Under New Proposal, Newsweek.

- Florida’s Housing Market Faces Major Setback As High Insurance Costs And Storm Concerns Drive Buyers Away,

Leaving Homeowners Stuck, Yahoo Finance. - Florida’s Battle Against Property Tax Could Upend Its Housing Market, Newsweek.

- Realtor says Save Our Homes cap chokes life out of Florida real estate, Sarasota Herald-Tribune.