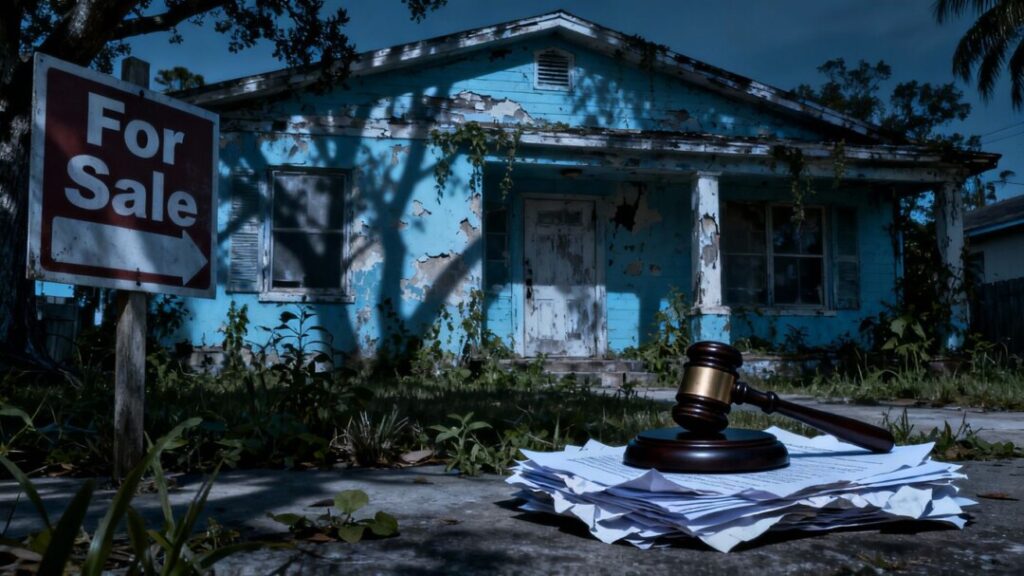

Florida’s real estate investment landscape is facing increased scrutiny as multiple firms and individuals are embroiled in investigations and legal proceedings related to alleged deceptive practices, Ponzi schemes, and significant tax fraud. Authorities are cracking down on schemes that prey on investors, promising high returns through real estate ventures.

Key Takeaways

- Florida Attorney General is investigating RAD Diversified REIT Inc. for potential deceptive practices and a possible Ponzi scheme.

- A former CEO of a real estate investment firm has been sentenced to federal prison for $6.29 million in tax fraud.

- A Boca Raton man faces charges for a $410,000 real estate scam that defrauded 16 investors.

RAD Diversified REIT Inc. Under Investigation

Tampa-based RAD Diversified REIT Inc. and its owners, Brandon “Dutch” Mendenhall and Amy Vaughn, are currently under investigation by Florida Attorney General James Uthmeier’s Office. The investigation stems from numerous complaints alleging that the firm may be violating the state’s Deceptive and Unfair Trade Practices Act. Mendenhall and Vaughn, who have gained a following as social media influencers promoting real estate investment seminars, are accused of pocketing investor funds instead of acquiring properties as advertised. The Attorney General’s office suspects a Ponzi scheme is in operation, with investors reporting difficulties in retrieving their returns or principal investments. Subpoenas have been issued, demanding documents related to the company’s operations, customer communications, and financial records to ascertain if the company’s real estate holdings match the value of customer investments.

Former Real Estate Executive Sentenced for Tax Fraud

In a separate case, Brian Davison, the former CEO of Tampa-based Equialt LLC, has been sentenced to three years in federal prison for tax fraud totaling $6.29 million. Davison was found to have significantly underreported his income from Equialt and other business entities between October 2018 and December 2020, failing to report at least $29.7 million in earnings. His company was previously placed into receivership following an SEC complaint regarding an alleged fraudulent unregistered securities offering that raised over $170 million from more than 1,100 investors. As part of his sentence, Davison has been ordered to repay the Internal Revenue Service the full amount of the defrauded taxes.

Boca Raton Man Accused of $410,000 Real Estate Scam

Authorities have arrested a Boca Raton man, Felipe Souza, for allegedly running a "bait and switch" scheme that defrauded 16 investors of over $410,000. Investigations initiated by the Florida Office of Financial Regulation (OFR) revealed that Souza, through his company FAS Creative Concepts LLC, promised investors guaranteed returns ranging from 200% to 338% on non-existent real estate deals. Investors provided funds for what Souza claimed were large loans for property flipping. However, instead of investing the money, bank records indicate Souza transferred a substantial portion to an associate, Michael Campbell, who also lacked the necessary licenses to sell securities or real estate in Florida. Both Souza and Campbell allegedly used the funds for personal expenses. Souza faces multiple charges, including selling unregistered securities and defrauding to obtain property.

Sources

- Tampa real estate investment firm under investigation for potential deceptive practices, Florida Politics.

- Florida AG probes Tampa real estate firm RAD over Ponzi scheme claims, The Business Journals.

- Florida Real Estate Investor Sentenced for $6.29 Million Tax Fraud, Weekly Real Estate News.

- Boca Raton man nabbed for $410K real estate scam, duping 16 investors, WPEC.