Palm Beach’s Million-Dollar Property Tax Boom

A New Era in Luxury Real Estate

Palm Beach is currently witnessing an unprecedented surge in luxury real estate, leading to an extraordinary rise in property tax bills that are exceeding $1 million. This phenomenon highlights the affluent lifestyle enjoyed by residents on the island, home to a number of billionaires and high-profile investors.

Ken Griffin: The Billion-Dollar Billionaire

Leading the way in extraordinary property tax contributions is Ken Griffin, a billionaire hedge fund manager whose bill surpasses $10 million. As reported by Bloomberg, his immense contributions are not merely an anomaly; they encapsulate the wealth represented within the Palm Beach community.

- Net Worth: $45 billion (Forbes)

- Recent Investments: Over $350 million on a vast estate at 60 Blossom Way, aimed at constructing a luxurious residence for his mother.

- Total Property Portfolio: Exceeds $1 billion in South Florida.

Griffin’s Luxurious Compound

The estate at 60 Blossom Way is characterized by:

- Extensive grounds

- High-end finishes

- Exceptional architectural design

This ambitious project underscores not only Griffin’s financial clout but also the thriving real estate market in Palm Beach.

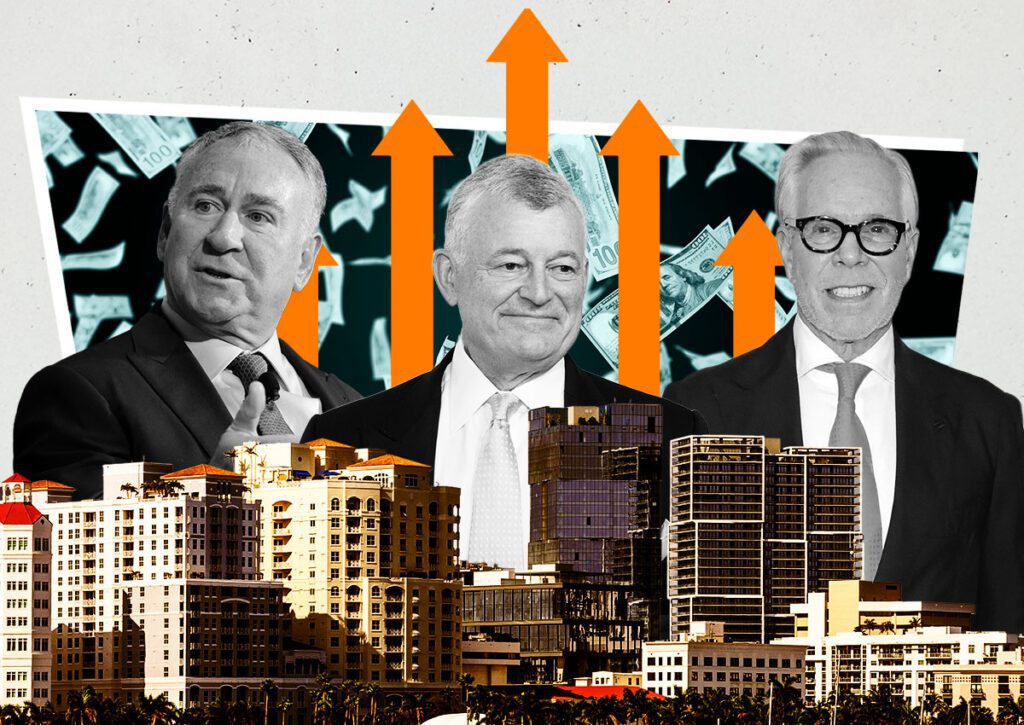

The Billionaires’ Club in Palm Beach

While Griffin’s tax burden is the highest, he is not the only Palm Beach homeowner with substantial property tax bills. Notable figures include:

- Tommy Hilfiger: Renowned fashion designer and investor.

- John Paulson: Hedge fund mogul who purchased an oceanfront mansion for $109.6 million in 2021.

- William Lauder: Heir to the cosmetics empire, who acquired Rush Limbaugh’s oceanfront estate for $155 million.

How Do High Taxes Benefit Palm Beach?

High property tax bills contribute significantly to the financial health of Palm Beach, a town with around 9,000 residents and approximately 2,500 homes. In the past year, property tax collections reached:

- Total for Palm Beach County: $359 million (75% increase since 2018)

- Town of Palm Beach: $84 million last year, up from $66 million in 2020.

According to Dorothy Jacks, the Palm Beach County property appraiser,

"It’s just been an enormous boom to our whole area. I don’t know that anything really surprises me anymore."

Understanding Property Taxes in Palm Beach

An Insightful Perspective

Explaining the nuances of property taxes, University of Chicago professor Christopher Berry notes:

“If I’m making $100 million a year, I’m paying a higher rate than somebody making $100,000 a year. But if I have a $100 million home, I’m paying the same rate as somebody with a $100,000 home. That doesn’t change the shock, you know, of a million-dollar property tax.”

This disparity highlights a critical aspect of property taxes: regardless of income, homeowners pay a fixed rate based on their property’s assessed value.

Conclusion

The remarkable surge in property taxes within Palm Beach signifies more than just the wealth of its residents. It indicates a robust and thriving luxury real estate market that is reshaping the town’s financial landscape. As billionaires continue to invest in this exclusive enclave, the implications for both the community and prospective homeowners are profound.

For more insights into the Palm Beach real estate market, explore these luxury property listings.