Florida Condo Market Faces Challenges Amid Broader Housing Market Shift

Florida’s once-thriving condominium market is experiencing significant challenges, reflecting a broader trend in the national housing sector. Despite a robust recovery following the pandemic, both sales and prices for condos have noticeably declined in recent quarters. This article explores the factors behind this downturn, the implications for buyers and sellers, and potential paths to recovery.

Current State of the Florida Condo Market

Decline in Sales and Prices

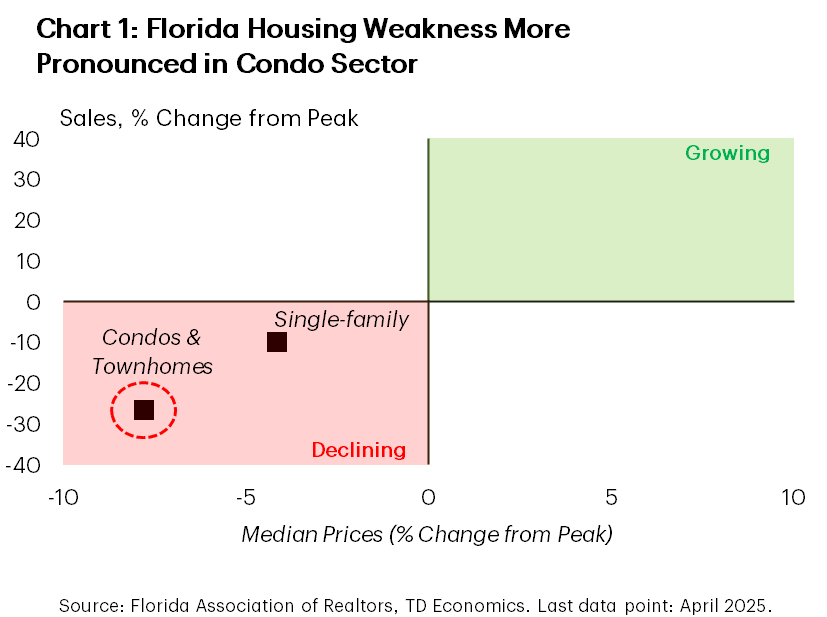

The Florida condo market, which had been a beacon of growth, has faced a downturn since peaking post-pandemic. Current data reveals:

- Sales Down by Over 25%: Recent statistics show that condo sales in Florida have dropped by more than 25% compared to levels prior to 2018-19.

- Median Prices Falling: The median price for condos has declined by roughly 8% from its peak, with a year-on-year drop of 4.5%. This trend starkly contrasts with the single-family home market, where prices have only dipped by about 2%.

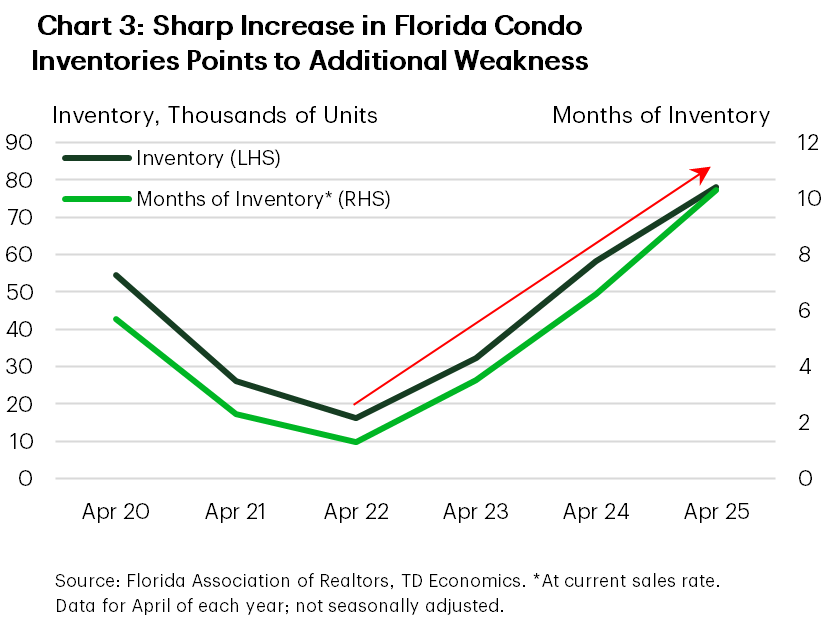

Growing Inventory Issue

The inventory of condos for sale has surged to nearly 80,000 units, representing a 35% increase from the previous year. This growing supply translates to over 10 months of inventory, significantly surpassing the 5.6 months typical for single-family homes. This inventory saturation indicates a shift firmly into "buyer’s territory," where supply exceeds demand.

Key Factors Contributing to Market Weakness

Increased Costs and Stricter Regulations

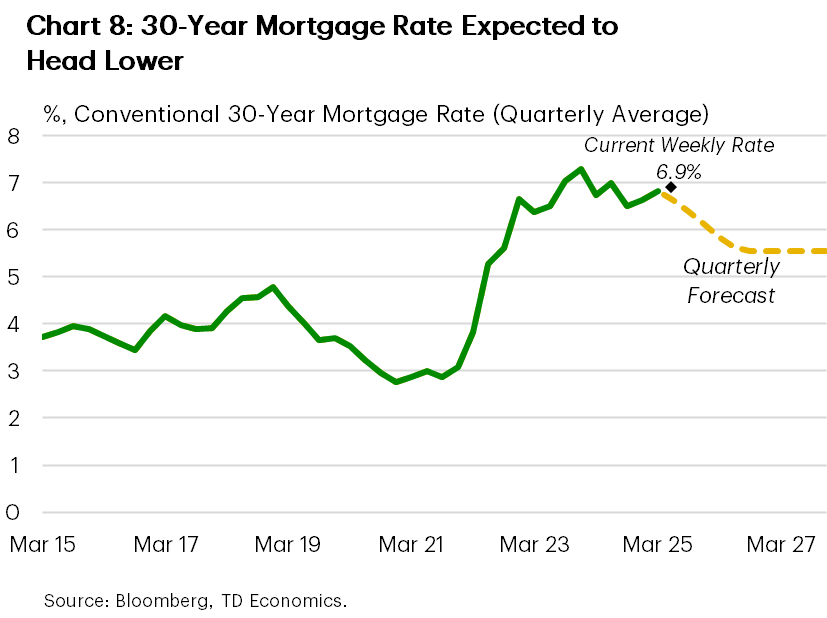

- Heightened Interest Rates: Current mortgage rates hover around 7%, contributing to buyer hesitation.

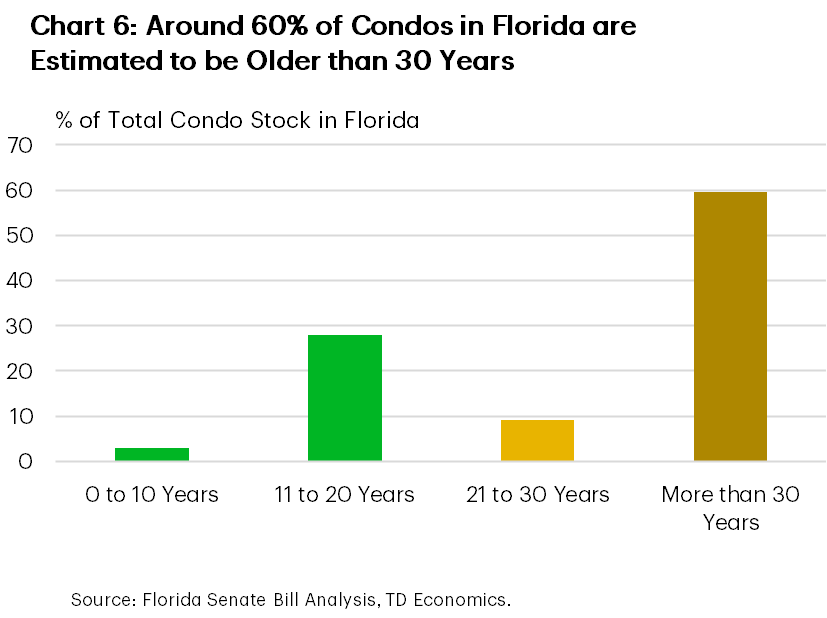

- Regulatory Changes: New laws mandating inspections for condos older than 30 years have heightened the burden on owners. Many properties are now facing necessary repairs that elevate Homeowners Association (HOA) fees significantly.

- Insurance Crisis: Florida experiences the highest homeowners’ insurance costs nationwide, with condo owners facing premiums double that of the national average.

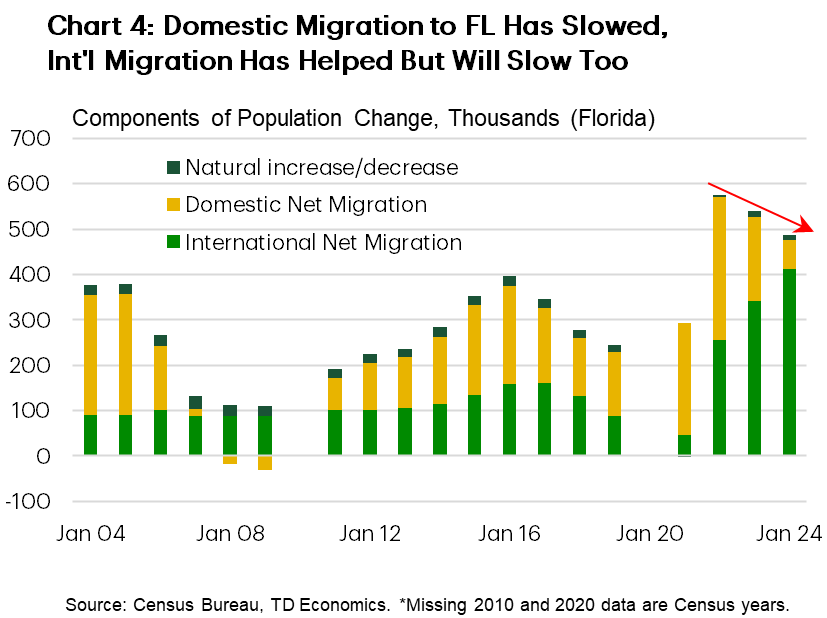

Domestic Migration Trends

The flow of new residents to Florida is also showing signs of slowdown. Domestic migration has fallen to its lowest levels since the 2008 financial crisis, further impacting demand in the housing market. Meanwhile, international migration is filling some gaps, with a strong increase in buyers from Latin America and Canada.

Challenges for Condo Owners

The combination of increasing costs and regulatory requirements is wreaking havoc on condo owners:

- Rising HOA Fees: Owners are seeing unprecedented hikes in HOA fees, compounded by the need for urgent inspections and repairs.

- Increased Assessment Payments: Special assessments for necessary repairs can add thousands to owners’ costs.

- Restricted Sales Market: Many condos are classified as risky investments by lenders, affecting their ability to sell due to a restricted buyer pool.

The Role of Foreign Owners

Florida is a hotspot for foreign buyers, who accounted for 20% of all home purchases in the U.S. last year. Factors affecting this demographic include:

- A weakening Canadian dollar.

- Increasing HOA costs.

- Altered travel requirements impacting "snowbirds" who spend winters in Florida, potentially leading to increased listings in the market.

A Unique Dynamics in Florida’s Housing Market

Condos make up a significant portion of Florida’s housing market, accounting for 15% of the total housing stock:

- About 1.5 million condos are located in the state, two-thirds of which are over 30 years old.

- These older units are particularly affected by regulatory changes.

Looking Ahead: Potential for Recovery

While current conditions in the condo market are challenging, there are several indicators that could lead to a gradual recovery by late 2026:

- Interest Rate Declines: Trends suggest mortgage rates may drop to between 5.5-6% in the upcoming years.

- Potential Changes to Regulatory Framework: Proposed modifications to regulations requiring structural integrity studies may alleviate financial pressures on condo owners.

- An Upturn in Immigration: A projected increase in employment-based immigration could bolster demand for housing, benefitting the condo sector.

Conclusion

The Florida condo market is navigating tumultuous waters, influenced by regulatory shifts, financial pressures, and changing buyer dynamics. Although foreboding in the short term, a convergence of easing interest rates, regulatory reforms, and potential shifts in migration patterns may pave the way for an eventual recovery. Monitoring these factors will be crucial for stakeholders aiming to understand and respond to the evolving landscape of Florida’s housing market.

For more insights into U.S. real estate trends, you can find valuable information on sites like Zillow and Realtor.com.