South Florida Condo Market Faces New Realities Amid Safety and Affordability Challenges

The South Florida residential real estate market experienced unprecedented growth following the COVID-19 pandemic, fueled primarily by an influx of residents drawn by the region’s sunny climate and economic opportunities. This rapid expansion, however, encountered significant obstacles following the June 2021 tragedy of the Surfside condominium collapse, which exposed critical safety vulnerabilities in aging high-rise buildings. The resulting legislative reforms have heightened building safety but imposed substantial financial burdens on condominium owners, deepening affordability issues in an already competitive housing market.

Impact of Surfside Building Collapse on Condominium Regulations

The catastrophic collapse of Champlain Towers South led to a comprehensive statewide audit, targeting all high-rise condominiums over 40 years old. In May 2022, the Florida Legislature enacted Senate Bill 4D, instituting mandatory milestone inspections for condominiums exceeding three stories. Key provisions of this law include:

- 30-year initial building inspection, followed by mandatory recertification every 10 years.

- Requirement for Homeowners’ Associations (HOAs) to maintain adequate reserve funds for maintenance, repairs, and replacement of aging infrastructure.

These safety measures aim to prevent future disasters and safeguard residents but come at a high financial cost for condo owners.

Financial Strain on Condo Owners: Special Assessments and Rising Fees

While prioritizing resident safety, these reforms have created severe economic pressure, particularly for vulnerable condo owners:

- Deferred maintenance issues resurfaced, pushing HOAs to levy special assessments often amounting to thousands of dollars per unit.

- HOA fees have escalated, sometimes reaching levels unaffordable for retirees and lower-income households.

- Insurance premiums for condos have surged, compounding financial burdens.

According to the Atlanta Fed’s Home Ownership Affordability Monitor, the Miami-Fort Lauderdale-West Palm Beach metro area shows a staggering 48% affordability rate—far exceeding the healthy threshold of 30%. This means nearly half the median income is spent toward homeownership costs, underscoring intensifying challenges for residents.

“Condominium ownership historically offered an affordable path to homeownership, particularly in amenity-rich urban locations,” notes Sarah Stein, senior adviser for affordable housing at the Atlanta Fed. “As safety policies trigger costly assessments, it’s imperative to find creative financial solutions to prevent displacement of lower- and fixed-income households.”

Broader Economic and Social Consequences

The rising condo ownership costs extend their impact beyond individual homeowners, posing broader risks such as:

- Increased foreclosures and forced sales, often to investors favoring redevelopment into luxury or mixed-use properties.

- Exacerbating housing affordability challenges, forcing displaced families to seek housing outside South Florida.

- Straining local labor markets as workers face higher living costs and longer commutes.

- Adverse effects on regional competitiveness, including business growth and consumer spending contraction.

Migration Patterns Shift Amid Affordability Pressures

South Florida has traditionally benefited from both domestic and international migration, gaining residents from states like New York, California, and Texas, enriching the labor force across industries such as hospitality, healthcare, and construction. However, the condo market crisis paired with evolving immigration policies has influenced migration trends:

- Out-of-state driver license exchanges dropped dramatically across Miami-Dade, Broward, Palm Beach, and neighboring counties in early 2025, signaling declining in-migration. (Source: Southeast Florida Driver License Exchange Report)

- A 4.3% increase in outward migration from Florida was reported in 2023, with significant relocations to North Carolina, Texas, and Georgia. (Source: Florida Chamber 2024 Migration Trends)

- Businesses report challenges attracting and retaining workers due to high housing costs and long commutes.

REIN, the Atlanta Fed’s Regional Economic Information Network, highlights that upward housing costs limit in-state housing options for middle-income earners and discourage higher-income workers from relocating to South Florida, creating a labor market bottleneck.

Condo Market Dynamics: From Boom to Buyer’s Market

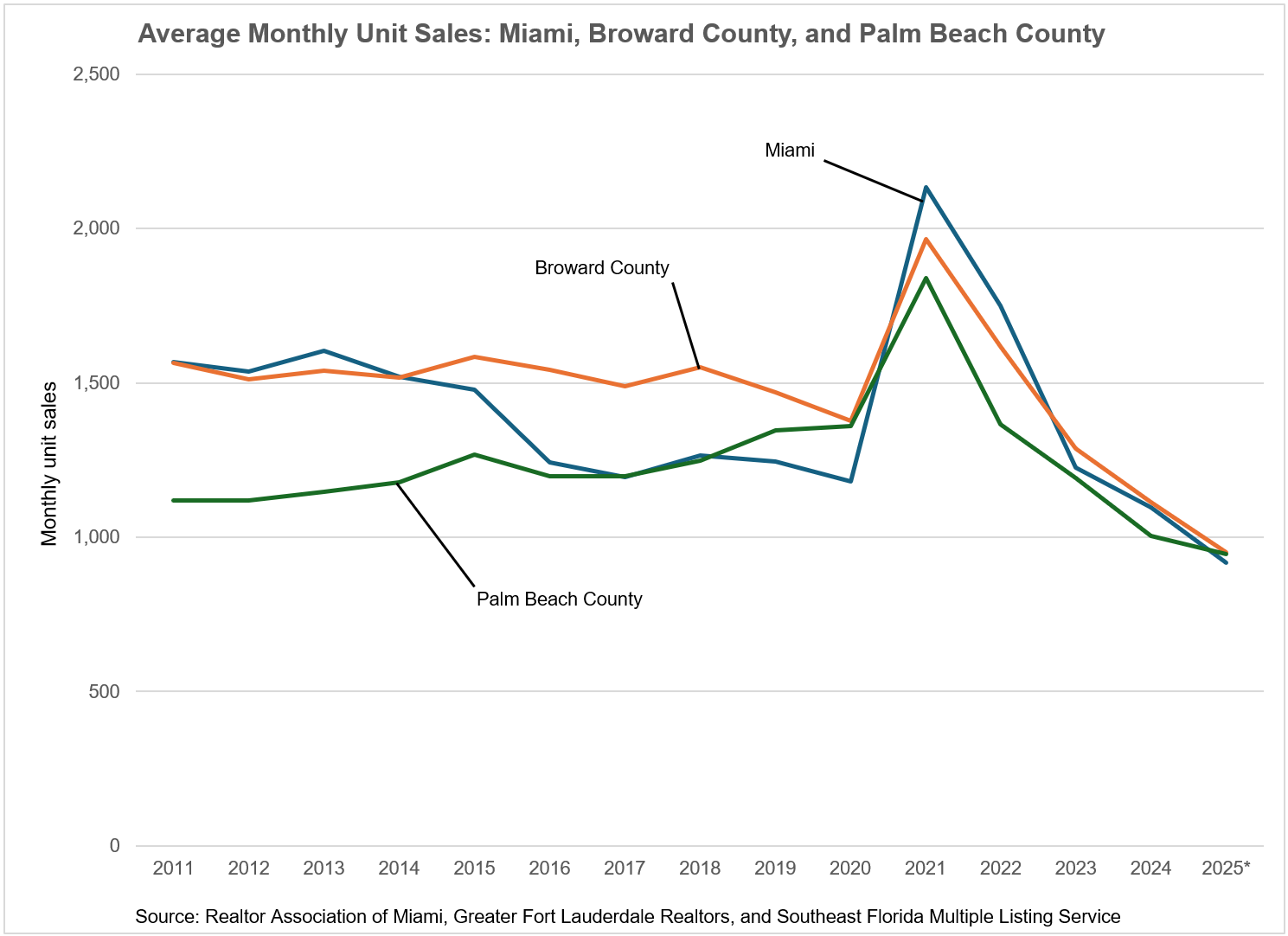

The combination of rising costs and migration shifts has altered condo market fundamentals:

- Inventory levels have increased, reversing the ultra-low supply seen in 2021.

- Demand for units under $500,000 has softened, expanding inventory to 11-12 months, signaling a buyer’s market.

- Condo prices have declined in Broward and Palm Beach counties by 6-7% during Q1 2025, while Miami-Dade prices remain relatively stable.

- Units sold monthly have dropped sharply compared to 2021 peaks:

- Miami-Dade: From 2,134 to 917 units

- Broward: From 1,964 to 950 units

- Palm Beach: From 1,839 to 945 units

Ron Shuffield of EWM Realty notes, “The market is clearly shifting, with growing inventory and slower sales. We anticipate stabilization later in 2025 as sellers recalibrate pricing, but affordability pressures persist.”

Legislative Relief and Future Outlook

In response to ongoing challenges, Florida’s governor recently signed House Bill 913, which:

- Allows certain HOAs to utilize special assessments, lines of credit, or loans to fund reserve accounts.

- Permits pooling of reserve funds across multiple associations to ease financial requirements.

These measures aim to reduce the immediate economic strain on condo owners while maintaining stringent safety standards.

Conclusion: Balancing Safety and Affordability in South Florida’s Condo Market

The South Florida condominium market stands at a crossroads. While safeguarding residents through stricter safety inspections is non-negotiable, the ensuing financial challenges pose serious threats to housing affordability, community stability, and regional economic vitality. Policymakers, HOAs, and stakeholders must collaborate to develop innovative financing, support mechanisms, and housing policies that protect residents both physically and economically.

Explore More About South Florida Real Estate Trends:

- Florida Real Estate Market Reports

- Miami-Dade Housing and Urban Development

- Atlanta Fed Regional Economic Analysis

By harmonizing safety imperatives with affordability solutions, South Florida can reclaim its position as an accessible and vibrant homeownership destination.