Florida’s Housing Market: A Dramatic Surge in Active Listings

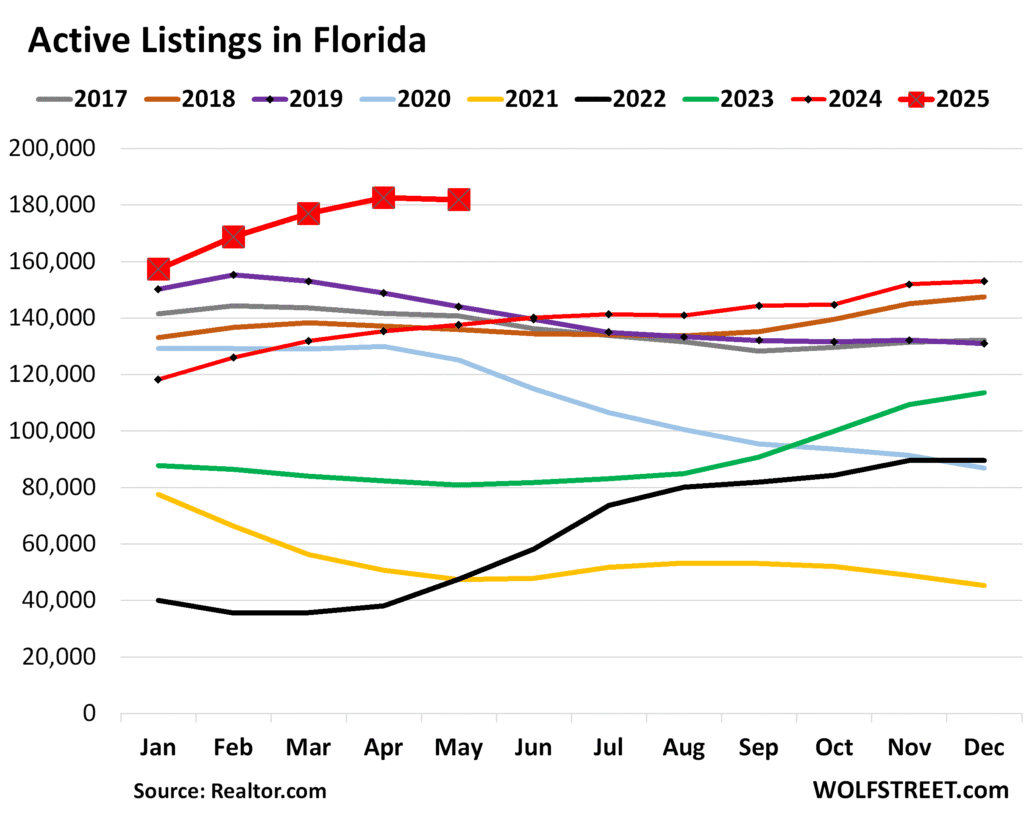

The Florida real estate market has witnessed a remarkable transformation in recent months. As of May, active listings of existing homes for sale surged by 32% year-over-year, totaling 181,822 listings. This increase is not only notable when compared to the previous year but also represents a 26% rise from May 2019 and a 34% increase from May 2018, marking a significant turnaround since the housing shortage experienced in 2021 and 2022.

A Busy Market: Inventory Levels Soar

Breakdown by Region

The active listings reveal striking growth across several key Florida markets:

- Lakeland: +80% compared to 2019

- Orlando: +42% compared to 2019

- Tampa: +40% compared to 2019

- Cape Coral-Fort Myers: +36% compared to 2019

- North Port-Sarasota: +36% compared to 2019

- Jacksonville: +25% compared to 2019

- Miami: +5% compared to 2019

Highest Levels of Inventory Recorded

April and May 2023 marked the peak for housing inventory according to data from Realtor.com, representing the highest levels since 2016. The benefits of this influx of homes can be significant for potential buyers.

-

Miami-Fort Lauderdale-West Palm Beach: 39% increase in active listings, totaling 51,901 homes—the highest for May.

-

Tampa-St. Petersburg-Clearwater: 31% increase, reaching 20,033 homes.

[link-whisper-related-posts] -

Orlando-Kissimmee-Sanford: 39% increase, with 13,994 homes in inventory.

- Cape Coral-Fort Myers: Active listings rose by 36%, with a total of 13,757 homes.

What’s Driving This Change?

The dramatic rise in active listings isn’t simply a result of new homes coming onto the market; instead, it is largely influenced by a drop in demand. Sales have sharply declined, as prices surged too quickly during the pandemic, leading many buyers to retreat.

Key Factors Affecting Demand:

-

Price Escalation: The market experienced a historic price spike driven by the "free-money" era of the pandemic. Mid-tier properties in Tampa, for instance, saw prices jump by 65% over two years, causing widespread affordability issues.

- Demand Destruction: The dramatic escalation in prices has led to a significant reduction in buyer activity, illustrated by a 31% drop in pending home sales in the South compared to April 2019.

Historical Context and Predictions

Comparisons Across Years

-

The current housing landscape shows inventory levels significantly higher than in both 2019 and 2018 across most metro areas.

- While Miami has served as a slower-growing market, other regions are seeing inventory swell beyond 30%–80% increases relative to previous years.

The Path Forward

Pricing plays a fundamental role in the recovery of demand. It is anticipated that, as sellers adjust their expectations, listings will take longer to shift, giving rise to potential market corrections. For instance, mid-tier condo prices in Tampa decreased by 11% from their mid-2022 peak.

Future Outlook

As the housing market navigates through these shifts:

- Increased Inventory: Expect ongoing adjustments in listing prices.

- Sales Activity: Lower prices will likely reignite buyer interest.

- Long-Term Trends: The ramifications of these changes will continue to shape Florida’s real estate landscape for the foreseeable future.

By staying informed on these trends, buyers and sellers alike can make more strategic decisions in this dynamic market.

For more detailed insights into the Florida housing market and its implications, please refer to Realtor.com for real-time data and analytics.

This evolution in Florida’s real estate inventory paints a complex picture, signaling potential opportunities for buyers and outlining challenges for sellers as they adapt to a more balanced market.