Private Equity Dealflow Timeline (2020-2025): Key Trends and Insights in the CPA Sector

Overview of Private Equity Investments

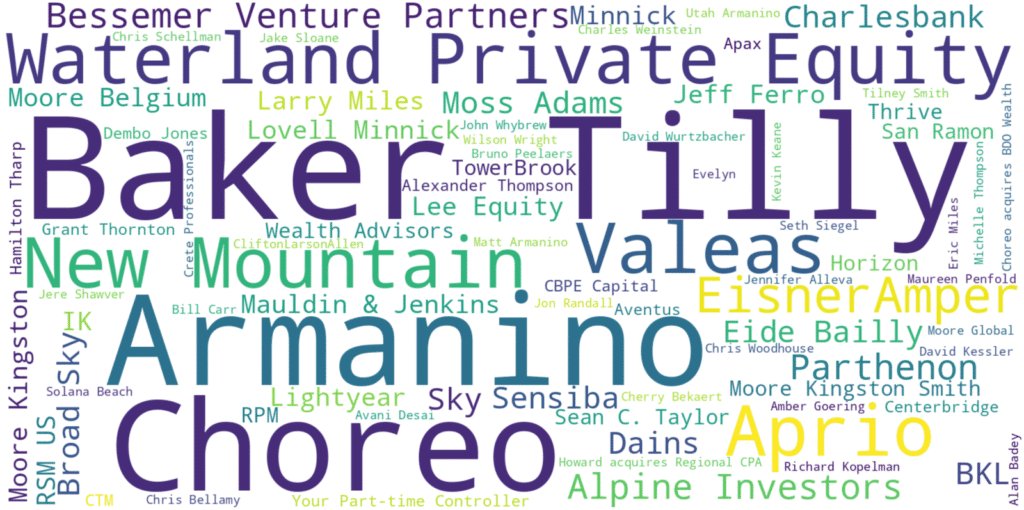

The CPA industry has witnessed significant private equity (PE) activity between 2020 and mid-2025, with over 52 major transactions documented. This surge in investment, totaling $28.2 billion, underscores a robust interest in the CPA and accounting sector, particularly outside the Big Four. This article delves into essential trends, benchmarks, and notable transactions shaping the landscape.

The Impact of Private Equity

- Investment Scale: Excluding the Big Four, PE has contributed more than six times the annual revenue of the next 96 firms, highlighting the strategic importance of these investments.

- Technology Adoption: Capital from private equity is being harnessed for advancements in AI technologies, high-value service offerings, and the acquisition of top talent.

Market Trends and Benchmarks

Revenue Projections

- Total Income Growth: The U.S. tax and accounting market is projected to reach $145.5 billion by 2025, with a compound annual growth rate of 0.2%.

- Service Demand: The increase is fueled by consistent demand for traditional accounting services as well as expanding advisory roles.

Employment and Productivity Statistics

- Sector Employment: Employment in accounting-related services has reached approximately 1.15 million, reflecting a slight growth trend despite a 10% decline in the workforce from 2019 to 2024 due to retirements and a lack of new professionals.

- Revenue Per Employee: The average revenue per employee stands at approximately $268,763, suggestive of a focus on productivity within the sector.

Future Outlook

- Employment Growth: Projections from the Bureau of Labor Statistics anticipate a 6% increase in employment for accountants and auditors through 2033, indicating sustained demand for professional services.

Deal Volume and Notable Transactions

Key Deal Insights

- Deal Count: The period from 2020 to mid-2025 saw over 52 significant transactions, indicating a vibrant market for mergers and acquisitions in the CPA sector.

- Top 30 Firms: Private equity has acquired stakes in 10 of the top 30 CPA firms, with projections that more than half will have PE ownership by the end of 2025.

Significant Transactions

Noteworthy Acquisitions and Mergers:

- Grant Thornton: In May 2024, New Mountain Capital acquired a 60% stake in Grant Thornton’s U.S. unit, emphasizing its non-audit business.

- EisnerAmper: In 2021, a majority stake was sold to TowerBrook Capital Partners, marking a breakthrough in U.S. PE investments.

Consolidation Trends

PE-backed firms like EisnerAmper and Citrin Cooperman are aggressively pursuing M&A strategies, each completing over a dozen acquisitions post-investment, showcasing a clear trend toward consolidation in the industry.

Industry Composition

The U.S. is home to approximately 46,000 to 52,200 CPA firms across about 55,000 locations. Notably, over 90% of these firms are classified as small practices, employing fewer than 20 staff members.

Growth in Consulting Revenue

- The CPA industry’s consulting services have generated approximately $7.8 billion in revenue in 2023, marking a 10% increase from the previous year.

Upcoming Deals and Trends

Recent and Upcoming Transactions (2025)

- Carr, Riggs & Ingram: Merged with Axley & Rode, expanding its regional footprint.

- Prosperity Partners: Acquired Danaher Attig & Plante, enhancing its New England market presence.

- Cherry Bekaert: Acquired Spicer Jeffries to strengthen its financial services practice.

- Aprio: Announced the acquisition of two firms to expand its Mid-Atlantic footprint.

Other Notable Deals in 2025

- Elliott Davis received PE investment from Flexpoint Ford, focusing on advisory and digital transformation services.

- Ascend expanded its reach with two additional firm acquisitions.

Conclusion

The interaction between private equity and the CPA sector from 2020 to mid-2025 has resulted in robust growth, strategic mergers, and innovative transformations. As the landscape continues to evolve, firms that adapt to emerging technology and sustain their competitive edge will undoubtedly thrive.

Additional Resources

For more updates on the latest trends and transactions in the accounting sector, stay tuned to our analysis and insights.