A Comprehensive Overview of Palm Beach County’s Real Estate Market in May 2025

Increased Dollar Volume in Single-Family Homes

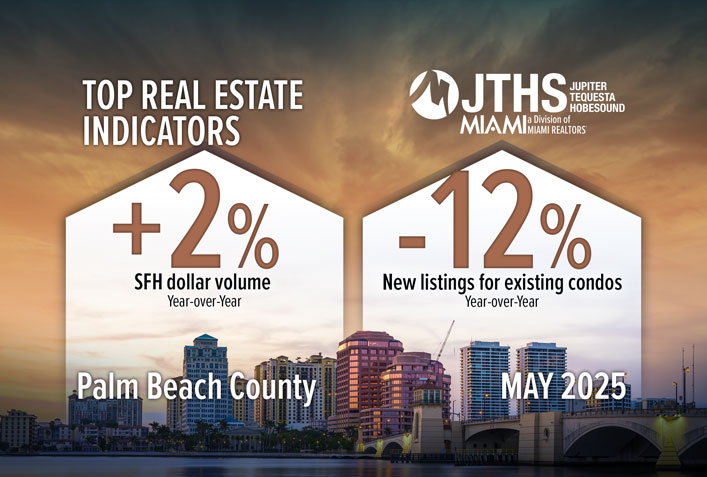

In May 2025, Palm Beach County witnessed a notable increase in the dollar volume of single-family home sales, rising 1.7% year-over-year to reach $1.86 billion. This upswing underscores the county’s attractiveness as a real estate hotspot, particularly for buyers relocating from high-tax, densely populated states like New York and California.

"Palm Beach County remains a top destination for buyers from high-taxed, high-density states," remarked Ginenne Boehm, the 2025 JTHS-MIAMI President.

Condominium Market Dynamics

While condo inventory is on the rise, providing more options for potential buyers, the number of sellers has not surged similarly. In May 2025, new listings for existing condos in Palm Beach County decreased by 12% year-over-year. However, it is worth noting that the overall condo prices appreciated markedly, showing an impressive 118.6% increase from May 2015 to May 2025—from $150,950 to $330,000.

- May 2025 Annual Statistics:

- Condo prices decreased slightly by 2.94%, from $340,000 to $330,000.

- Statewide, condo prices also fell by 6.1% year-over-year.

Single-Family Home Market Trends

Palm Beach County’s single-family home prices reflect a robust appreciation trend with a 116.9% increase over the last decade, lifting the median sale price from $295,000 in 2015 to $640,000 in 2025. However, year-over-year, median sale prices have seen a slight decrease of 0.78%.

Broader Economic Impacts

Changes in the housing market directly influence the broader economy. According to the National Association of Realtors (NAR), each home sale generates an economic impact of approximately $129,000. In May 2025, the sale of 2,275 homes in Palm Beach County resulted in an estimated $293 million economic effect on the local economy.

Sales Trends and Inventory Insights

Palm Beach County’s total sales experienced an 11.6% decline year-over-year, influenced by factors like elevated mortgage rates and inventory shortages at critical price points. Specifically, single-family home sales fell 7.3%, totaling 1,334 closed sales.

Inventory Statistics

The total active inventory at the end of May 2025 rose significantly, showing a 23.4% increase year-over-year to 14,471 listings. Key figures include:

- Single-Family Home Inventory: Increased by 25.12% to 6,391 active listings.

- Condominium Inventory: Increased by 22% year-over-year, reaching 8,080 listings.

Current Market Indicators:

- Single-Family Homes: Balanced inventory at 5.8 months supply.

- Condos: A buyer’s market with a 10.2 months supply.

Market Affordability and Financing Challenges

The recent volatility in mortgage rates has contributed to sluggish sales, with 30-year fixed-rate mortgages averaging 6.81% as of June 2025. The lack of financing options for existing condominium buildings further complicates the real estate landscape, with only 21 out of 2,397 buildings in the area approved for FHA loans.

Cash Transactions in Palm Beach County

Interestingly, 49.1% of closed sales in Palm Beach County were cash transactions. This high percentage reflects the area’s appeal to foreign buyers and individuals profiting from sales in costlier markets.

- Cash Sales Breakdown:

- Condos: 58.1%

- Single-Family Homes: 42.9%

Future Outlook and Legislative Support

Looking forward, initiatives like Florida’s Live Local Act, which incentivizes developers to create affordable housing, are expected to encourage further growth in the housing sector. This legislation aims to allocate a portion of units for affordable housing while maximizing density allowances.

National Comparisons and State Trends

While Palm Beach County’s market demonstrates resilience, national trends indicate a slight downward trajectory for home sales. In May 2025, total existing-home sales nationally decreased by 0.7%, and Florida single-family home sales were down 5.7% year-over-year.

Key Metrics:

- Statewide Median Sale Price for Single-Family Homes: $415,000

- National Median Home Price: $422,800, marking a record high.

Conclusion

Palm Beach County’s real estate market showcases a complex interplay of rising inventory, fluctuating prices, and an undeniable draw for buyers from other states. As market conditions evolve, stakeholders and potential homeowners are encouraged to stay informed regarding economic factors, legislative changes, and financing options.

For Further Information

To access more detailed statistical reports on Palm Beach County’s real estate market, explore this link.

This article aims to provide a comprehensive understanding of the current state of Palm Beach County’s real estate, focusing on market performance, pricing trends, and economic impacts while optimizing for search engine visibility.