Miami-Dade’s property tax landscape and market stabilization were central topics as officials discussed the county’s preliminary taxable property value for 2025. The figures reveal an 8.7% increase, with new construction significantly contributing to this growth. However, the Property Appraiser is urging local governments to consider lowering tax rates to address the ongoing housing crisis.

Property Value Surge and Market Stabilization

Miami-Dade County’s preliminary taxable property value for 2025 has reached $512.3 billion, an 8.7% increase from the previous year. This growth is partly fueled by a substantial rise in new construction value, which jumped from $6.3 billion in 2024 to over $8.6 billion for 2025. Despite this upward trend, Property Appraiser Tomás Regalado believes the real estate market is stabilizing and anticipates potential value decreases in certain markets. He has called on local governments to roll back tax rates to alleviate the housing crisis.

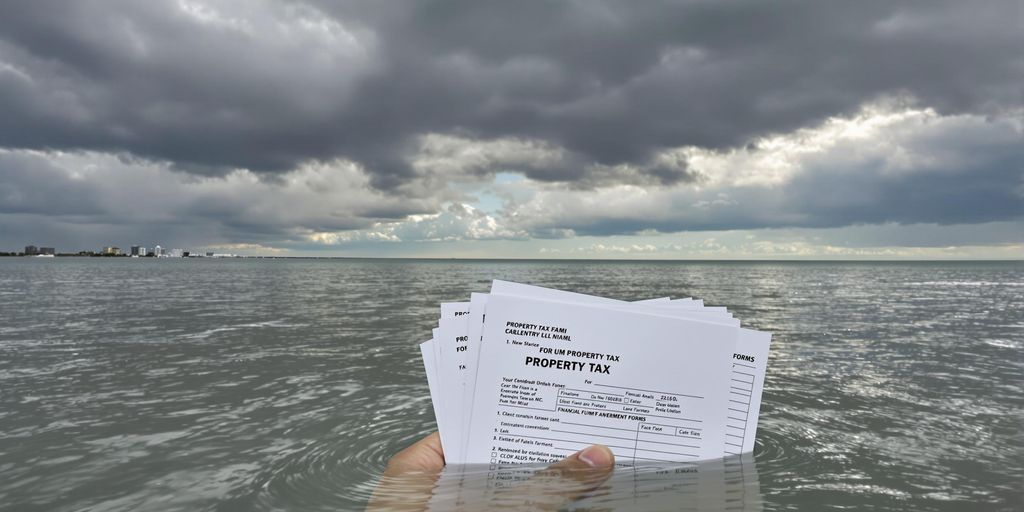

Climate Change and Property Assessments

Tomás Regalado, the newly appointed Property Appraiser, is exploring the integration of climate change impacts, such as sea-level rise and flooding, into property value assessments. He argues that these factors are crucial for 21st-century property appraisals and could lead to lower property values in vulnerable areas. This approach aims to provide relief for current homeowners and address housing affordability. While the exact methodology is still being developed, Regalado believes this change could be reflected in the 2026 tax rate assessments. County Mayor Daniella Levine Cava has expressed support for efforts to alleviate homeowner costs and enhance community resilience.

Property Tax Debate and Potential Impacts

The discussion around property taxes in Florida has intensified, with proposals to eliminate them altogether. However, such a move could have significant financial implications. A study by the Florida Policy Institute suggests that eliminating property taxes would necessitate a substantial increase in the state sales tax, potentially doubling it from 6% to 12%, to compensate for the lost revenue. This shift could disproportionately affect lower-income residents and impact consumer spending. Property taxes currently fund essential local services like schools, public safety, libraries, and infrastructure.

Key Takeaways

- Miami-Dade’s preliminary taxable property value for 2025 shows an 8.7% increase, driven by new construction.

- Property Appraiser Tomás Regalado advocates for incorporating climate change impacts into property valuations.

- Regalado urges local governments to lower tax rates to combat the housing crisis.

- Eliminating property taxes in Florida could lead to a significant increase in the state sales tax.

Candidate Landscape for Property Appraiser

The race for Miami-Dade Property Appraiser features two main candidates: Marisol Zenteno and Tomás Regalado. Zenteno, a veteran property appraiser with a decade of experience in the Property Appraiser’s Office, has secured endorsements from Xavier Suarez and the Miami Realtors PAC. Her campaign emphasizes professionalism and experience. Regalado, a former Mayor of Miami, is focusing on affordability and incorporating climate change into assessments. He has significantly outraised Zenteno and garnered support from various law enforcement and labor organizations. The election is set to replace the outgoing Property Appraiser Pedro Garcia.

Sources

- Xavier Suarez, Realtors PAC endorse Marisol Zenteno for Miami-Dade Property Appraiser, Florida Politics.

- How climate change could change property taxes in Miami-Dade, WLRN.

- Ex-Miami Mayor competes with property-assessing vet for Miami-Dade Property Appraiser job, Florida Politics.

- End of property taxes? This other tax might double, WPTV.

- Miami-Dade Sees 8.7% Increase in Preliminary Taxable Property Value, Hoodline.