March Home Prices Decline: An Insight into the Current Real Estate Trends

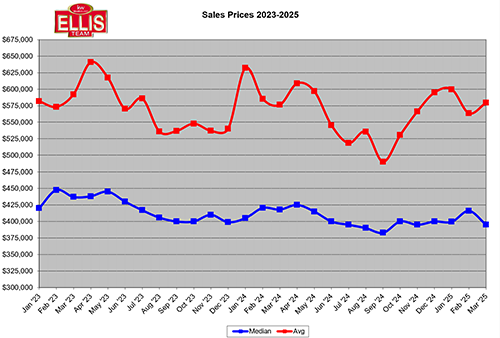

Single-family home prices experienced a notable decline of 5.5% in March compared to the previous year, a steep increase from February’s modest 1.1% drop. This significant change raises questions about whether this downturn represents the start of a new trend in the housing market.

The Shift in Home Prices

Historically, the peak of the real estate market occurred in April 2022, where median and average prices reached their highest. With the upcoming release of April’s year-over-year data, it will be interesting to assess how current prices compare to those record highs. Many potential buyers may be tempted to delay their purchases, anticipating further decreases in prices. However, they may not realize that the decline commenced after May 2022 and continued through 2023 and 2024.

Key Factors Influencing Price Declines:

-

Seasonality: Many agents primarily focus on year-over-year numbers, missing ongoing declines that began in 2022. Seasonal patterns often mask these trends, complicating market assessments.

- Inventory Levels: Inventory of single-family homes reached its lowest point on February 15, 2022, after which levels began to rise significantly, indicating an impending shift in the market.

The Impact of Rising Interest Rates

In March 2022, the Federal Reserve started increasing interest rates, a response to rampant inflation and economic challenges. This increase affected housing demand, illustrating the lag time between changing rates and market responses. The year 2022 thus marked the beginning of significant changes in the real estate landscape.

Rising Interest Rates: Key Takeaways

- Fed Policy Changes: Interest rate hikes can lead to decreased buyer demand.

- Economic Impact: Overextension in government spending has had lasting effects on the economy, creating additional challenges for potential homebuyers.

Insurance and Natural Disasters

Hurricane Ian’s Aftermath

Hurricane Ian, which struck on September 28, 2022, forced insurance companies to reassess their policies and pricing in light of increased flooding threats. Prior to 2022, Southwest Florida faced minimal flooding issues, but Ian’s impact changed the landscape significantly.

Following Flooding in 2024

- Recurring Storms: The region faced additional threats from storms, Helen and Milton, in 2024, prompting further shifts in buyer behavior.

- Buyer Behavior: The experience of flooding has led many buyers to reconsider properties in flood zones, prompting a migration inland away from waterfront locations.

Tracking Your Home Value

In light of these market shifts, understanding your home’s value is crucial. Consider using our Free Online Home Value Tool for real-time updates and insights on your property’s worth.

Conclusion: As the market continues to evolve, it is vital for both buyers and sellers to stay informed about changes in home prices and sales dynamics. With the fluctuations in rates, insurance implications, and the impact of natural disasters, prospective homeowners should analyze all factors before making decisions.

For further insights and guidance through this changing real estate market, communities can reach out to local experts.

By engaging with the real estate community and utilizing available tools, investors and homeowners can navigate this evolving market with confidence. Stay tuned for upcoming analyses and reports on the housing market trends in your area.