Florida lawmakers are deep in discussions about potentially reshaping or even eliminating property taxes, a move championed by Governor Ron DeSantis. The proposed reforms aim to provide relief to homeowners struggling with rising costs, but raise significant concerns about the impact on essential local government services like public safety and education. The debate involves complex policy questions and carries substantial political implications as the state heads towards the 2026 election.

Key Takeaways

- Proposals range from significant increases in homestead exemptions to the complete elimination of property taxes.

- Local governments warn that drastic cuts could lead to reduced services and increased reliance on other taxes.

- Governor DeSantis is a strong proponent of property tax relief, viewing it as a key issue.

- Any constitutional changes would require voter approval via a referendum in November 2026.

The Push For Reform

Governor Ron DeSantis has been a vocal advocate for property tax reform, arguing that the current system prevents Floridians from truly owning their homes. His administration, along with allies like CFO Blaise Ingoglia, has been critical of local government spending, suggesting that property taxes are unnecessarily high due to wasteful practices. This push has led to the formation of a House Select Committee on Property Taxes, which has been holding hearings to explore various options.

Potential Impacts and Concerns

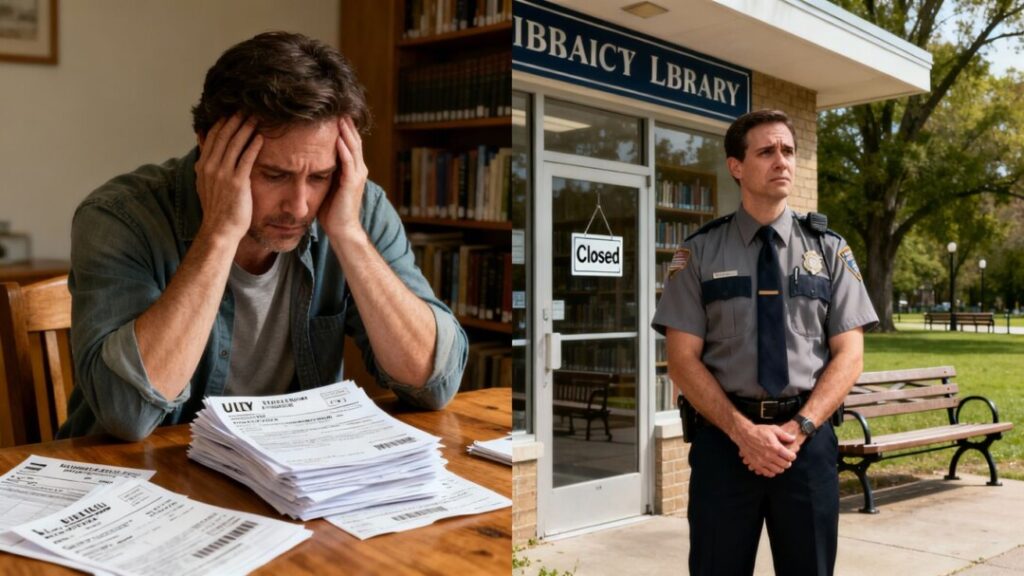

The proposed changes could dramatically alter how Florida funds its cities and counties. Eliminating property taxes entirely would create a substantial budget deficit, potentially necessitating service cuts, increased sales taxes, or other fees. Some lawmakers are considering significantly increasing homestead exemptions, which currently provide up to $50,000 in tax relief for owner-occupied homes. Proposals to raise these exemptions to $700,000 or even $1 million could shift the tax burden heavily onto commercial properties or force significant reductions in public services.

Local government officials and representatives from organizations like the Florida League of Cities have expressed strong concerns. They argue that property taxes are crucial for funding essential services such as police, fire rescue, and schools. They point to rising costs due to inflation and population growth as drivers of increased spending, and emphasize that budget decisions are made based on resident priorities. Some also highlight that many mandated costs, like those for sheriff and property appraiser offices, are outside their direct control.

Political Landscape

The property tax debate is intertwined with Florida’s political future. Governor DeSantis’s focus on this issue is seen by some as a strategic move ahead of his potential presidential aspirations. The upcoming gubernatorial race also adds a layer of complexity, with candidates like Congressman Byron Donalds expressing caution about the potential consequences of drastic tax reductions, including the possibility of doubling the sales tax.

Alternative Perspectives

While some residents, like Margie Morrison Richardson, feel burdened by rising property taxes and insurance costs, others, such as Jacksonville homeowner Suzi Stone, prioritize addressing the escalating cost of homeowners insurance. Democrats in the legislature have also voiced concerns that the focus on property taxes might distract from other pressing affordability issues. Florida TaxWatch, a fiscal watchdog group, advocates for a measured approach, suggesting a phased approach to property tax reduction and emphasizing the need to maintain essential services.

The Path Forward

Any significant changes to Florida’s property tax system will likely require voter approval through a referendum on the 2026 election ballot. Lawmakers are navigating a complex landscape, balancing the desire for tax relief with the need to ensure the continued provision of vital public services. The outcome of these discussions will have long-lasting effects on the state’s fiscal structure and the lives of its residents.

### Key Takeaways

- Florida lawmakers eye property tax reform, homestead exemption hike, The Business Journals.

- Who’s helped, hurt by DeSantis push to upend property taxes?, Sun Sentinel.

- Florida House lawmakers poised to take up property tax changes, WUSF.

- Florida lawmakers move toward property tax changes, JaxToday.