The Current Landscape of Real Estate: Trends and Market Insights for Investors

Are you an investor in rental properties? Understanding the evolving landscape of real estate markets is crucial for making informed decisions. This article delves into the latest trends, including shifts in home prices across various regions, the impact of recent policy changes, and what investors should watch for in the coming months.

Key Takeaways

- Year-Over-Year Home Prices: National home prices saw a modest increase of +2.1% from February 2024 to 2025, down from the prior year’s +4.6%.

- Market Decline: Out of the 300 largest metro areas, 42 are experiencing declines in home prices.

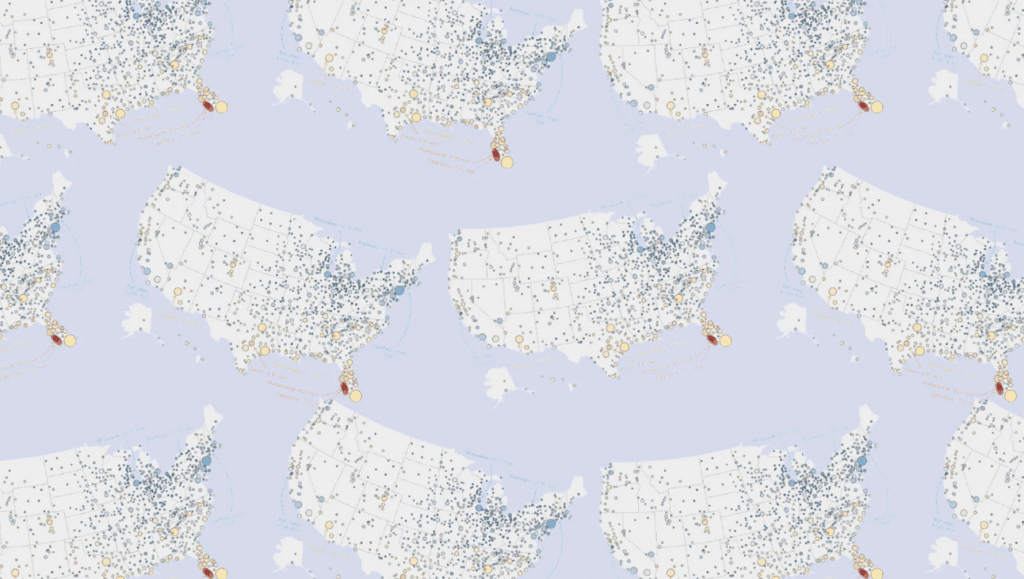

- Geographic Discrepancies: Regions with tight inventory like the Northeast are seeing price rises, while places such as Texas and Florida are witnessing corrections due to increased inventory.

Home Price Trends Across Major Markets

Declining Markets

Recent data indicates that 42 housing markets are witnessing falling home prices year-over-year, an increase from 31 the previous month. Notable markets experiencing declines include:

- Austin, TX: -3.8%

- Tampa, FL: -3.6%

- San Antonio, TX: -2.0%

- Phoenix, AZ: -1.6%

- Jacksonville, FL: -1.5%

Rising vs. Falling Prices: A Closer Look

Despite growing national home prices, disparities exist:

- Rising Prices: Areas with limited inventory, especially in the Northeast and Midwest, are seeing growth.

-

Falling Prices: States like Texas, Florida, and Louisiana are showing modest corrections with the number of markets declining:

- Texas: 9 out of the 42

- Louisiana: 4 out of the 42

- Arizona & Colorado: 3 each

What’s Causing These Trends?

The housing boom during the pandemic saw rapid price increases that now appear unsustainable. As mortgage rates rise and pandemic-related migration slows, markets are readjusting to more stable price levels.

Market Adjustments

These adjustments are influenced by:

- New Home Supply: Construction in the Sun Belt has surged, often with builders offering discounts and incentives, leading some buyers to prefer new homes over existing ones.

- Active Inventory Levels: Increased active inventory in markets like Tampa—now above pre-pandemic levels—could signify ongoing softening, providing more opportunities for homebuyers.

The Impact of Economic Policies

Tariff Announcement and Its Implications

Recently, President Trump introduced new tariffs, including a 10% baseline tariff on imports effective April 5, 2025. This policy has stirred concerns about:

- Economic Slowdown: Analysts believe that higher tariffs could compress corporate earnings and potentially trigger a recession.

- Investment Shifts: Many investors are moving towards bonds as a safer option amid fears that rising tariffs may impact economic growth.

What This Means for Mortgage Rates

With the bond market reacting to economic signals:

- As bond prices rise, long-term yields—including mortgage rates—tend to decline, creating a mixed environment for homebuyers and investors alike.

Looking Ahead: Opportunities for Homebuyers

As we analyze these trends, it’s essential to keep an eye on:

- How active inventory levels evolve in weakening markets.

- The potential for further price adjustments, especially in areas awash with new construction and increased supply.

In conclusion, understanding the dynamics of current real estate trends is key for investors and homebuyers. While some markets show promising growth, others exhibit signs of correction and softness, particularly in the Sun Belt. By staying informed and adaptable, investors can navigate this complex landscape effectively.

That’s where our ResiClub PRO members come into play, offering exclusive insights and research to help maximize your investment strategies and decisions. Join us as we explore the evolving landscape of real estate.