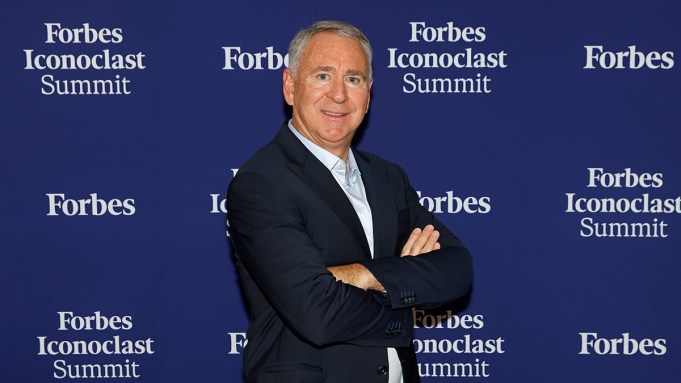

Inside Ken Griffin’s Luxurious Real Estate Empire

Ken Griffin, founder and majority owner of Citadel LLC, isn’t just a titan in finance; he is also a major player in high-end real estate. With a personal fortune estimated at $48 billion, Griffin’s real estate portfolio stands as a testament to his wealth, establishing him as one of the premier buyers of trophy homes across the United States and beyond.

A Diverse Portfolio

Griffin’s real estate investments are as varied as they are stunning. From iconic penthouses in Manhattan to lavish estates in Palm Beach, his holdings reflect both opulence and a keen eye for investment opportunities.

Manhattan Masterpiece

- Record-Breaking Penthouse: Griffin made headlines with his acquisition of a $238 million penthouse, the most expensive residential sale in U.S. history. Located at 220 Central Park South, the apartment spans multiple floors and boasts 24,000 square feet.

- Additional Properties: Not one to stop there, he has also purchased two adjacent units in the same building, pushing his total investment in this iconic property to approximately $244 million.

Palm Beach Dominance

In Palm Beach, Griffin has been assembling an enviable portfolio:

- Contiguous Properties: Since 2012, he has quietly acquired over 25 acres of prime land, with notable purchases including a 4.5-acre estate for a whopping $104.99 million.

- Billionaires Row Development: Plans are in motion for a mega-mansion that could cost between $150 million and $400 million to build, possibly valued at $1 billion upon completion.

Aspen Abode

Griffin has also made significant investments in Aspen:

- Exclusive Properties: His collection includes two homes bought in the Tiehack area, alongside recent acquisitions in 2024 for a combined $66 million.

Global Footprint

Miami Momentum

In 2022, Griffin shifted Citadel’s headquarters from Chicago to Miami, a move closely aligned with his real estate strategy:

- Luxury Estates: He purchased Adrienne Arsht’s waterfront estate for $106.9 million, marking the most expensive residential sale in Miami-Dade County history.

- Star Island Investments: Since 2023, Griffin has invested approximately $169 million in seven parcels, reinforcing his commitment to the Miami market.

European Ventures

Griffin’s international investments include:

- London Luxury: In 2019, he acquired a Georgian mansion at 3 Carlton Gardens for approximately £95 million, making it the highest residential sale in the UK since 2011.

- Saint-Tropez Retreat: In 2024, he bought Domaine de la Capilla for over $90 million, cementing his status on the French Riviera.

The Art of Real Estate Investment

Griffin’s approach to acquiring real estate is notably strategic:

- Enclave Acquisition: He often buys multiple adjacent properties to create sprawling estates.

- Luxury and Utility: Each property is selected not only for its opulence but also for its potential as an investment.

Closing Thoughts

Ken Griffin’s real estate empire is a mix of jaw-dropping luxury and shrewd investment. From coast to coast and across the globe, his portfolio illustrates how wealth becomes legacy through exquisite properties. As Griffin continues to expand his holdings, the impact of his investments will undoubtedly echo throughout the luxury real estate market for years to come.

Explore More

For further insights into the world of luxury real estate and financial titans, explore these articles:

With each acquisition, Griffin not only raises the bar for luxury living but also shapes the landscape of investment in high-value real estate.