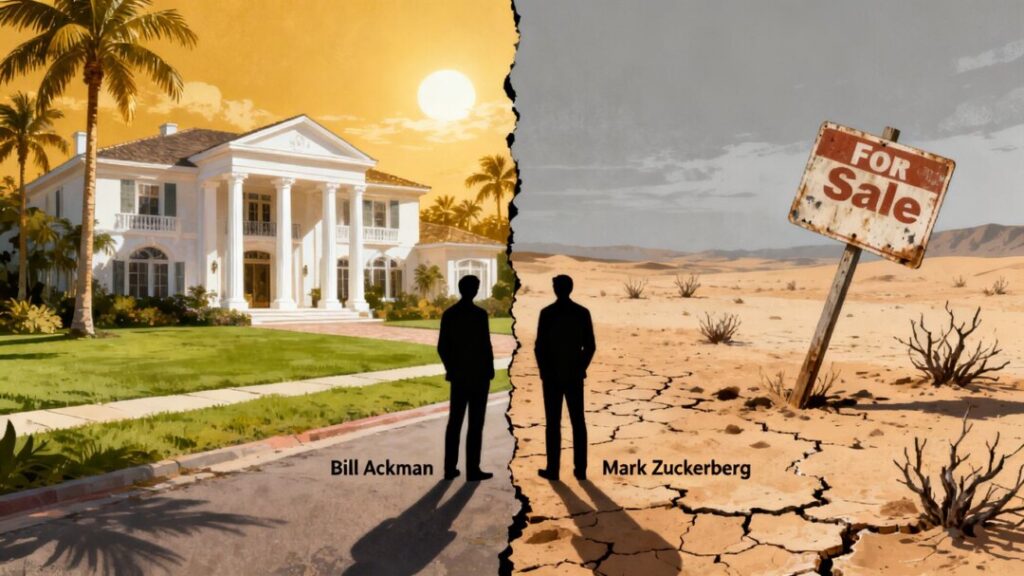

Billionaire investor Bill Ackman has weighed in on Meta CEO Mark Zuckerberg’s recent acquisition of a lavish waterfront mansion in Florida, valued between $150 million and $200 million. Ackman suggests this move, along with similar actions by other tech titans, signals a significant shift away from California, which he dramatically declared "toast."

Key Takeaways

- Mark Zuckerberg has purchased a high-value mansion in Florida, sparking speculation about his motivations.

- Bill Ackman believes Zuckerberg’s move is a strategic financial decision to avoid potential wealth taxes in California.

- Other prominent tech figures like Sergey Brin and Larry Page have also reduced their ties to California.

- The trend highlights ongoing debates about wealth taxes and the appeal of states with no income tax.

Zuckerberg’s Florida Acquisition

Mark Zuckerberg and his wife, Priscilla Chan, are reportedly finalizing the purchase of an off-market waterfront mansion on Miami’s exclusive Indian Creek island. While the exact price remains undisclosed, local real estate experts estimate it to be between $150 million and $200 million. This significant real estate investment by the California-based billionaire has fueled discussions about his reasons for expanding his presence in Florida.

Ackman’s Bold Prediction

Hedge fund manager Bill Ackman was quick to link Zuckerberg’s Florida purchase to California’s proposed billionaire tax initiative. This ballot measure, if approved, would impose a one-time 5% tax on the wealth of the state’s wealthiest residents. Ackman reposted an analysis suggesting that by relocating, Zuckerberg could potentially save over $10 billion in future wealth taxes, making the Florida mansion a financially astute move.

Furthermore, Ackman echoed speculation that if Meta were to increase its operational presence in Florida, employees could benefit from an "immediate raise" due to the state’s lack of a personal income tax, a stark contrast to California’s high marginal tax rates. Ackman’s blunt assessment of California’s situation was "California is toast. Self-immolation."

A Trend Among Tech Elites

Zuckerberg is not alone in making significant moves away from California. Google co-founder Sergey Brin recently transferred a substantial portion of his business interests out of the state, terminating or relocating 15 California LLCs. Larry Page, another Google co-founder, has also reduced the connection between his assets and California. Additionally, PayPal co-founder and early Facebook investor Peter Thiel announced the opening of a new office for his investment firm in Miami.

The Debate on Wealth and Taxes

The actions of these ultra-wealthy individuals underscore the ongoing debate about whether the wealthiest Americans are contributing their fair share in taxes. The current U.S. tax system, which often taxes capital gains at lower rates than income and defers taxes until assets are sold, is a key factor in how billionaires build and retain wealth. The appeal of states with no income tax, coupled with potential wealth taxes in states like California, appears to be driving a migration of capital and individuals.

Sources

- Bill Ackman Talks Mark Zuckerberg’s $150M Florida Mansion, MoneyWise.com.