Appeals Court Revives Class Action Lawsuit Against Grant Cardone

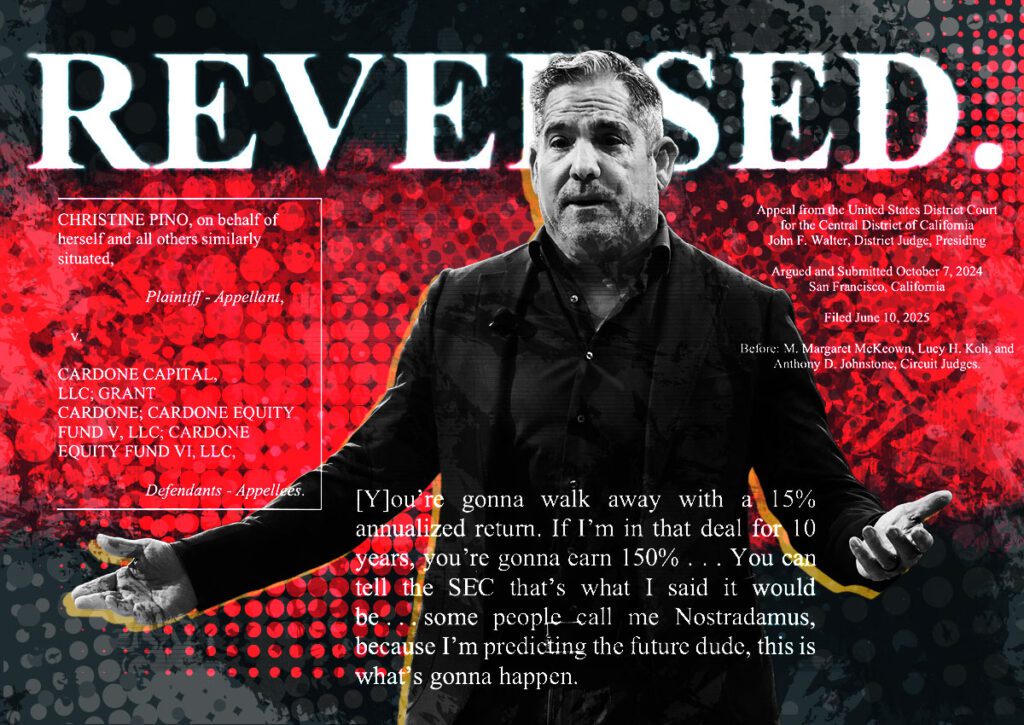

A significant legal development unfolded last week in the ongoing conflict between investor Christine Pino and real estate mogul Grant Cardone. The California U.S. appeals court has reinstated Pino’s class action lawsuit against Cardone, Cardone Capital, and affiliated real estate funds, which was initially dismissed in October 2023.

Background of the Case

Christine Pino inherited the lawsuit from her late father, Luis Pino, who had filed the suit in 2020. Luis alleged that Grant Cardone, known for his investment strategies and social media presence, misrepresented crucial information to investors. The core allegations included:

- Misleading statements about investor returns

- Downplaying financial liabilities

- Not fully disclosing fees associated with investments

Luis Pino had invested $10,000 in two of the funds named in the case, which was filed in a Los Angeles federal court. After his passing, Christine became the new plaintiff in an amended lawsuit, aiming to pursue these claims.

Grant Cardone’s Response

In a statement to The Real Deal, Grant Cardone asserted:

“It is obvious to any savvy person that this is a legal attempt to get a monetary settlement from me… There has been no financial damage and the investment is outperforming our objectives.”

[link-whisper-related-posts]

Cardone further emphasized that prior to Luis Pino’s death, he had offered to refund the $10,000 investment, to which Luis responded that he was satisfied with it. He claimed his firm has successfully returned $100 million to investors over the past year, including $20 million this month, with an average cash distribution nearing 7%.

Court Rulings and Findings

The appeals court concluded that Christine Pino’s claims were sufficiently strong to warrant further consideration:

- The court identified opinion statements made by Cardone, which he allegedly subjectively doubted.

- The omission of a letter from the Securities and Exchange Commission (SEC), which warned Cardone about certain projected rates of return and distributions, was deemed a material omission.

These findings imply that the case now has merit that requires closer examination.

Insights into Grant Cardone’s Business Model

Grant Cardone is a well-known multifamily syndicator who appeals to small investors through a robust social media presence, boasting over 10 million followers across various platforms. His investment model involves:

- Selling minority interests in properties through crowdfunding

- Managing a diverse portfolio valued at around $5 billion, including:

- 14,000 apartments

- Two office properties covering over 500,000 square feet

Recently, a Cardone affiliate made headlines by submitting a $230 million stalking horse bid for the 101 Via Mizner project in Boca Raton, which is currently under bankruptcy protection.

Conclusion

The revival of Christine Pino’s lawsuit against Grant Cardone signals a critical moment in this legal battle. With the court’s ruling indicating potential merits to Pino’s claims, it underscores the complexities involved in real estate investments and the responsibility of fund managers to provide transparent information to investors.

As the case unfolds, it serves as a reminder for both current and prospective investors to scrutinize disclosures and understand their rights within the investment landscape. For more insights on investor rights and financial transparency, visit Investopedia.