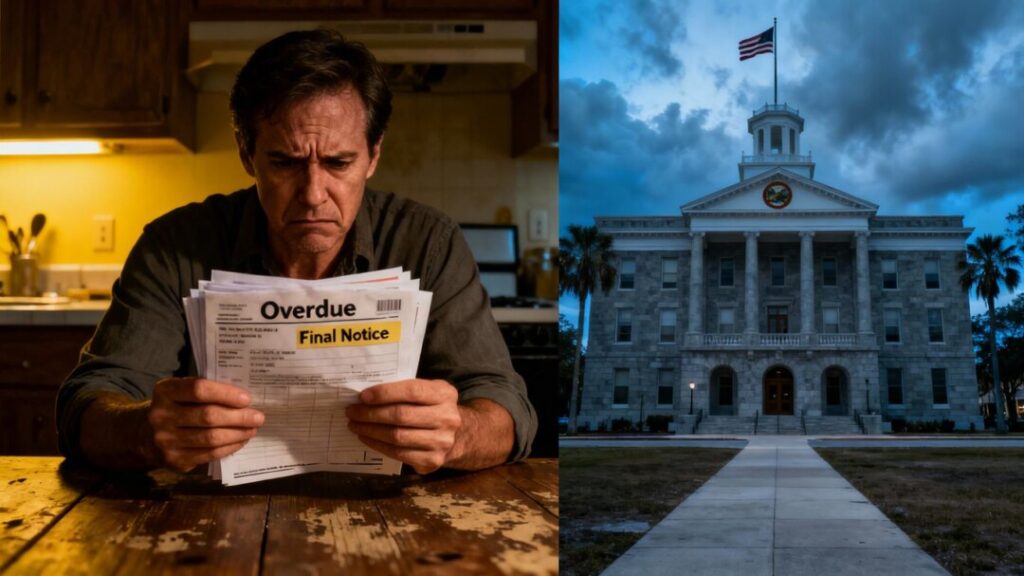

Florida lawmakers are actively exploring significant changes to the state’s property tax system, a move championed by Governor Ron DeSantis. The proposals aim to provide property tax relief, but concerns linger about the potential impact on essential local services and the overall affordability crisis.

Key Takeaways

- Lawmakers are considering various property tax reform options, including eliminating taxes on primary residences or significantly increasing homestead exemptions.

- Concerns exist that reducing property tax revenue could lead to cuts in public services like education and public safety.

- Homeowners are experiencing rising insurance costs, which some argue is a more pressing affordability issue than property taxes.

- Any proposed changes to the property tax system would require voter approval via a referendum in November 2026.

The Push For Property Tax Relief

Governor Ron DeSantis has made property tax relief a central theme, advocating for a reduction in what he views as an excessive burden on homeowners. He has expressed a fundamental opposition to taxing primary residences, questioning the government’s right to continuously collect taxes from homeowners. State lawmakers, through committees like the House Select Committee on Property Taxes, are beginning to examine potential solutions.

Potential Reforms And Their Implications

Several reform avenues are being discussed. One significant proposal involves eliminating property taxes on primary homes, a move estimated to cost local governments around $18.5 billion annually. This could necessitate either raising other taxes and fees or making substantial cuts to services. Another approach gaining traction is a significant increase in homestead exemptions, potentially raising them from the current $50,000 combined limit to as much as $700,000 or $1 million. Such a change would also create a substantial budget shortfall for local entities.

Local Government Concerns

Local officials and representatives from organizations like the Florida League of Cities have voiced strong opposition to drastic property tax reductions. They argue that these taxes are crucial for funding essential services such as police and fire departments, schools, and infrastructure. They contend that budget shortfalls would inevitably lead to service reductions or increased reliance on other revenue streams, potentially shifting the tax burden elsewhere. Local officials also point to rising costs due to inflation, population growth, and increased construction expenses as drivers of current spending.

Homeowner Perspectives And The Insurance Crisis

While some residents, like Margie Morrison Richardson, are struggling with the combined costs of property taxes and insurance and support property tax relief, others, such as Jacksonville homeowner Suzi Stone, believe the focus should be on the escalating cost of homeowners insurance. Many residents report that insurance premiums have risen at a much faster rate than property taxes, making it a more immediate concern for their household budgets.

Political Landscape And Future Steps

The property tax debate is intertwined with political ambitions. Governor DeSantis is seen as pushing for a significant legislative win before his term limits expire. Allies of the governor are actively campaigning on the issue, while potential successors like Congressman Byron Donalds have expressed caution about the potential economic impacts, such as a possible doubling of the sales tax if property taxes are eliminated. Any proposed constitutional amendments related to property taxes will be put before voters in the November 2026 election for final approval.

### Sources

- Florida lawmakers move toward property tax changes, JaxToday.

- Florida lawmakers eye property tax reform, homestead exemption hike, The Business Journals.

- Who’s helped, hurt by DeSantis push to upend property taxes?, Sun Sentinel.