Southwest Florida Home Prices: A June 2024 Update

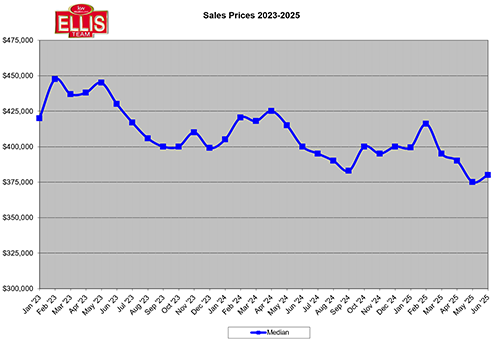

The real estate landscape in Southwest Florida has seen some notable shifts as we enter mid-2024. Recent data indicates that median home prices dropped 5% in June compared to last year, while average home prices decreased by 4.1%. This trend raises questions about what the future holds for buyers and sellers in the region.

A Silver Lining for Buyers

Despite the declining prices, there is good news for potential homebuyers:

- Fewer Listings: The market is seeing a reduced number of homes for sale. The difference between available listings and pending sales is narrowing, leading to a more competitive situation for buyers.

- Increased Pending Sales: Recently, single-family home pending sales saw an uptick, indicating that buyers are still active in the market.

- Inventory Decrease: Across the board, there’s been a decrease in inventory for single-family homes, condos, and manufactured homes.

The pressing question remains: What will happen as we move further into the season?

Positive Changes in Insurance Rates

The real estate market is also benefiting from changes in the insurance sector:

- Entry of New Carriers: Recently, two more insurance providers have entered the Florida market, adding to the 14 that have joined since the beginning of 2023.

- Rate Decreases: A total of 27 companies have requested to lower their rates for policies set to take effect in 2024 or later. Meanwhile, 41 companies are maintaining stable rates.

- Reduction in Citizens Policies: Citizens Property Insurance multi-peril policies represent only 9% of all policies in Florida, down from 16.7% last September.

These reforms are proving effective in reducing rates, with property insurance lawsuits also down by 23% in 2024, followed by another 25% drop this year.

Future Outlook for Home Prices

With the current trajectory, home prices in Southwest Florida are still declining. Interest rates remain relatively unchanged, and the reduction in insurance costs contributes to better affordability for buyers. Here’s what experts are predicting:

- Economic Improvement: As the economy strengthens, more home sales are anticipated.

- Impact of Shadow Inventory: The dynamics of shadow inventory could also influence future price trends.

While many factors are at play—some working in opposing directions—these fluctuations often indicate critical shifts in the market.

Timing the Market: Is Now the Right Time?

Can you truly time the market?

- Past insights suggest it’s nearly impossible. However, strategies exist for those contemplating buying or selling.

- Experts believe home prices may continue to decline slightly before stabilizing as inventory diminishes.

Key Takeaways for Buyers:

- Prices may not surge as they did during the COVID boom, where interest rates fell below 3%.

- If you identify a home that meets your needs, now may be the right time to act. Market declines can level off, making it crucial to buy before economic conditions shift.

Staying Informed

To keep track of the real estate market in Southwest Florida, check resources like SWFL Home Values. This platform offers insights into housing price trends and local market conditions.

Conclusion

As we navigate through mid-2024, the Southwest Florida real estate market continues to present both challenges and opportunities. Buyers are in a favorable position now, but shifts can happen rapidly. Staying informed and proactive may yield beneficial outcomes in your real estate journey.

For more insights on market trends and advice on buying or selling, explore valuable resources and expert commentary in reputable outlets.