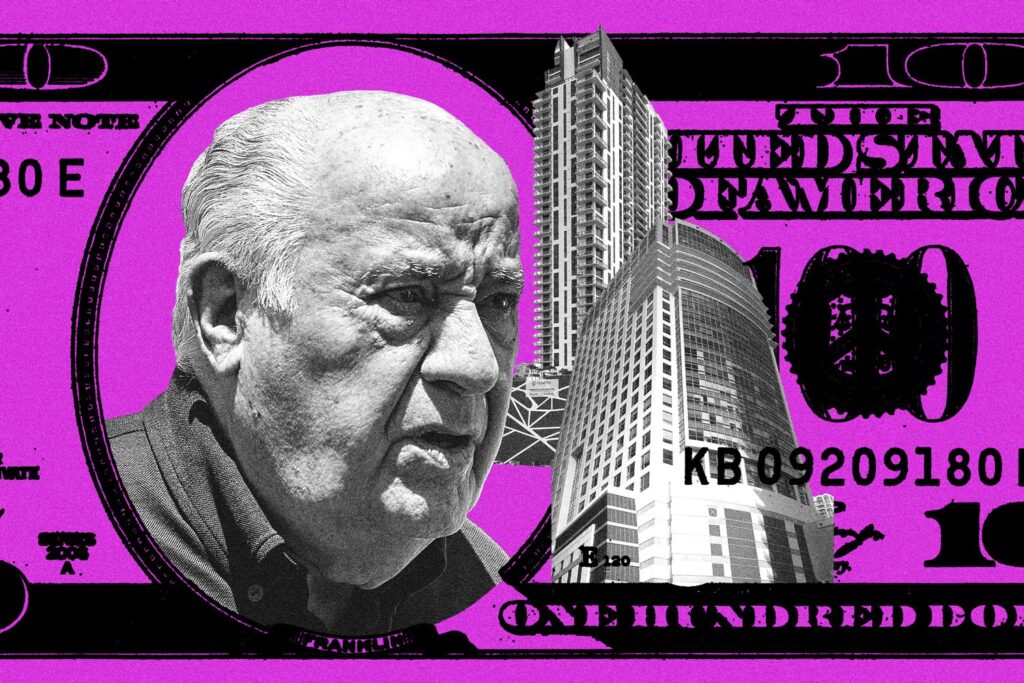

Amancio Ortega’s Summer Real Estate Wave in South Florida

Spanish billionaire Amancio Ortega, renowned for founding the global fashion retailer Zara, is embarking on an aggressive summer investment spree in South Florida’s booming real estate market. With a staggering net worth of $115 billion, Ortega ranks as the 13th richest person in the world, according to Forbes.

Recent Major Acquisitions

Ortega’s investment firm, Ponte Gadea, has recently acquired significant properties in South Florida:

- Sabadell Financial Center (Miami’s Brickell): Purchased for approximately $275 million.

- Veneto Las Olas (Downtown Fort Lauderdale): Acquired for $165 million last month.

These purchases total $440 million, showcasing Ortega’s strategic focus on Florida’s office and multifamily markets.

Why South Florida?

Ortega’s attention towards South Florida is not unfounded. Here’s why:

- High Occupancy Rates: Both Brickell and downtown Fort Lauderdale are experiencing robust occupancies.

- Rising Rents: These areas offer competitive rental rates, making them attractive for real estate investments.

The Advantage of Cash Buying

Ponte Gadea’s status as an all-cash buyer provides them a significant advantage, especially in the current higher interest rate climate.

Insights from Industry Professionals

Robert Given, a representative from CBRE, highlighted the preference for cash buyers:

“Companies that are able to close all cash are a preferred buyer today… most sellers are looking for certainty of closing over the highest price.”

Competitive Bidding

In the case of Veneto Las Olas, Ponte Gadea was selected as the buyer over four other firms that offered bids approximately 2% to 3% higher—albeit with financing. The assurance of a cash transaction made all the difference in this competitive landscape.

- Veneto Details:

- Listed Price: $230 million

- Final Sale Price: $165 million, translating to 637,066 per unit

- Occupancy Rate: 95% at the time of sale

Sabadell Financial Center

For the Sabadell Financial Center, Ponte Gadea emerged as the chosen buyer, despite competing offers. Successful negotiation led to a deal that, if completed for $275 million, will be the largest office sale in South Florida this year.

Global Real Estate Footprint

Ortega’s real estate investments extend well beyond Florida:

- Recently spent $113 million on the Hotel Banke in Paris.

- Invested $284 million in a large office building in Barcelona housing the Planeta headquarters.

- Plans to acquire a 49% stake in Brookfield Asset Management’s PD Ports in the U.K., though exact terms remain undisclosed.

Strategic Financial Moves

Expected to receive $3.6 billion in dividends from his retail empire this year—his largest payout to date—Ortega’s active investment in real estate could be a strategic move to shield these assets from substantial wealth taxes in Spain.

A Legacy of Discretion

Despite his immense wealth and extensive portfolio, Ortega remains a figure of discretion. He maintains a low profile, having given interviews to only a handful of journalists. This approach is a rarity in the South Florida real estate scene, known for its more publicized transactions.

Notable Past Investments

- Epic Residences & Hotel: Completed in 2008 in Downtown Miami, featuring 414 hotel rooms and 362 condos.

- Southeast Financial Center: Acquired for $516.6 million in 2016, marking one of the largest office purchases in the region.

Conclusion

Amancio Ortega’s strategic investments illustrate a keen understanding of both local and global real estate markets. By focusing on cash transactions in a volatile economic climate, Ponte Gadea positions itself as a formidable player in the prestigious South Florida real estate landscape. For more insights on Ortega’s investment strategies and the broader real estate market, visit the National Association of Real Estate Investment Trusts.