The Rise of Cryptocurrency ATMs: How Bitstop is Leading the Charge

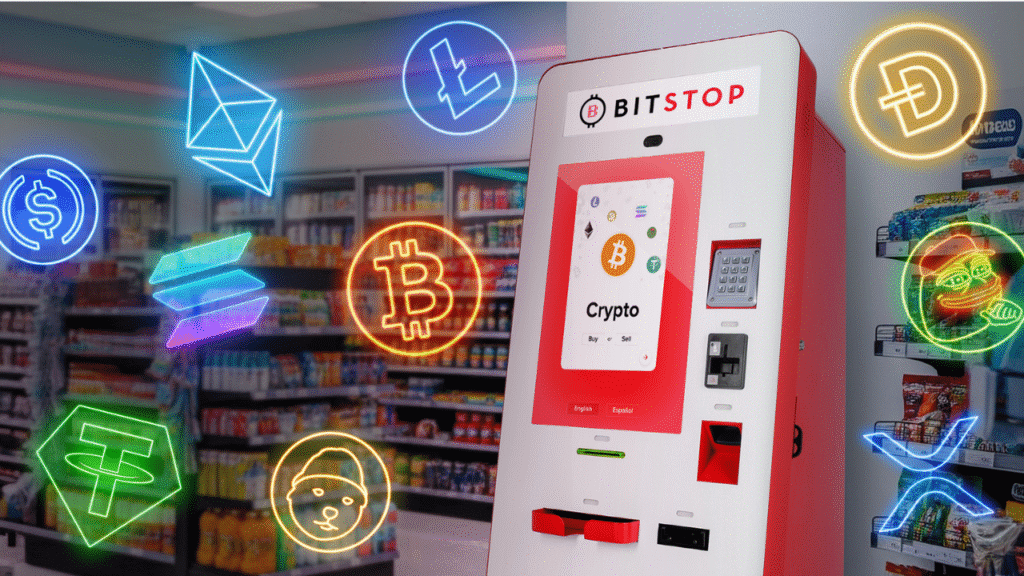

Cryptocurrency is now more accessible than ever, with a surge in crypto ATMs simplifying the process of buying digital currencies. At the forefront of this transformation is Bitstop, a Miami-based fintech company that operates the largest Bitcoin ATM network in the United States. The company is rapidly expanding its reach throughout Florida and beyond, offering users an efficient way to acquire cryptocurrency.

A Brief History of Bitstop

Founded in 2013, Bitstop was a pioneer in bridging traditional cash with cryptocurrency. In 2019, the company launched the first Bitcoin ATM at Miami International Airport. This innovation allowed users an immediate way to purchase various cryptocurrencies using cash, all while adhering to compliance and security measures.

Extensive Cryptocurrency Options

Bitstop stands out by supporting a multitude of digital currencies. Users can buy:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Solana (SOL)

- Tether (USDT)

- USD Coin (USDC)

- Pepe Coin (PEPE)

- Dogwifhat Coin (WIF)

According to Doug Carrillo, Bitstop’s co-founder and Chief Strategy Officer, "We’re bringing digital currency to the people because that’s what they’re asking for. Crypto isn’t just for tech insiders anymore—it’s for everyone with cash and a reason to diversify."

Timely Expansion Amid Regulatory Changes

Bitstop’s expansion comes at a crucial juncture. As lawmakers in Washington prepare to vote on important cryptocurrency legislation, discussions include:

- The GENIUS Act: Aiming to regulate stablecoins.

- The Clarity for Payment Stablecoins Act: Defining roles for the SEC and CFTC.

- The Anti-CBDC Surveillance State Act: Prohibiting a government-issued digital dollar.

Additionally, the SEC has been working to facilitate the approval of crypto exchange-traded funds (ETFs), while federal banking regulators have lifted restrictions allowing traditional banks to manage crypto assets. Earlier this year, President Donald Trump enacted Executive Order 14178, establishing a U.S. Strategic Bitcoin Reserve and banning a government-controlled digital currency.

These developments signify a growing acceptance of cryptocurrency, enhancing access and infrastructure for consumers. Services like Bitstop are becoming increasingly vital as this acceptance grows.

Competition and Consumer Safety

Bitstop is not alone in the Bitcoin ATM market. Competitors such as Bitcoin Depot, CoinFlip, RockItCoin, Athena Bitcoin, Coinhub, and Byte Federal are also in the mix. All operators are registered as Money Service Businesses and must adhere to federal anti-money-laundering (AML) and know-your-customer (KYC) regulations. Recent calls from the U.S. Senate Judiciary Committee have urged major operators to implement additional protections against fraud, especially for older Americans.

Identifying Legitimate ATMs

To ensure secure transactions, consumers can identify legitimate crypto ATMs by checking for:

- Clear branding

- Licensing information

- Security prompts

Bitstop’s ATMs can be located via bitstop.co, alongside external directories like CoinATMRadar.com, which lists thousands of crypto ATMs available in South Florida, including Broward and Palm Beach counties.

Simplicity is Key

One of Bitstop’s significant advantages is its user-friendly design. There’s no need for apps, brokerages, or crypto wallets. Users simply insert cash, select from various digital currencies, and complete their transaction—all within a secure framework.

Carrillo emphasizes, "This is about democratizing access. People want in—and we’re making it as easy as tapping a screen."

Looking Ahead

As Bitcoin prices continue to rally, new federal regulations are being crafted, and cryptocurrency adoption spreads from Wall Street to Main Street. Bitstop is strategically positioning itself as a trusted and accessible cryptocurrency resource for everyone.

To locate a Bitstop ATM or to find out more about their services, visit bitstop.co.

Embrace the future of money—one transaction at a time.