MV Realty Accused of Swindling Homeowners: A Deep Dive into the Controversy

TAMPA, Fla. — Florida’s Attorney General has taken action against MV Realty, alleging the company has been deceiving homeowners by “swindling consumers out of their home equity.” The lawsuit aims to compel MV Realty to remove documents from public records that have encumbered the titles of hundreds of properties across the state.

What’s the Controversy?

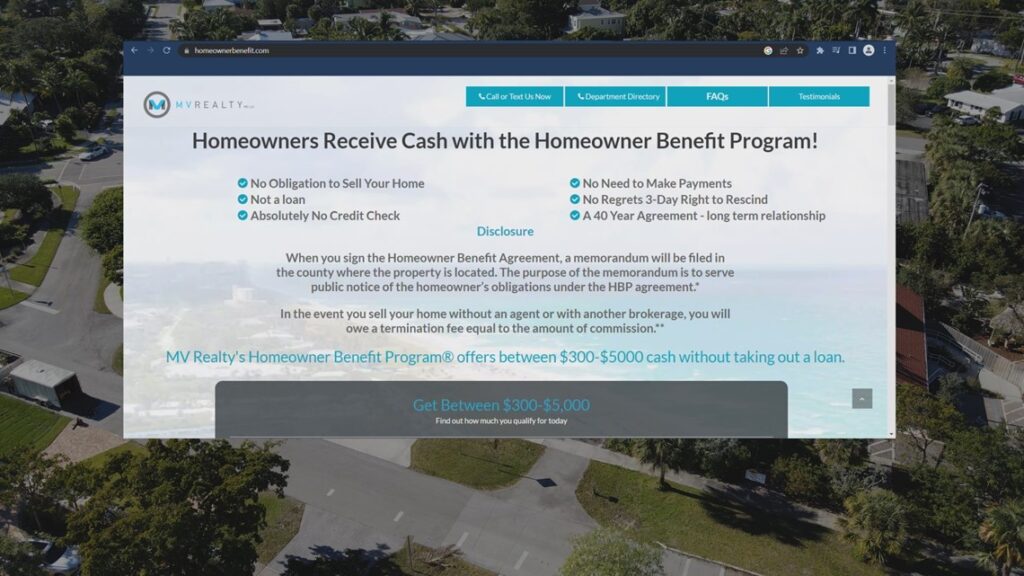

MV Realty, based in South Florida, provides cash to homeowners in exchange for exclusive rights to list their properties. However, many homeowners are reportedly unaware that the agreements last for 40 years and create liens that cloud their property titles.

Key Points:

- Long-Term Contracts: Homeowners enter into contracts without realizing they bind them for four decades.

- Public Records Issues: The agreements are recorded publicly, acting as a lien on the homeowner’s property.

- Lawsuit Filed: The Attorney General’s office has requested the removal of these agreements from public records.

Homeowners Speak Out

Many homeowners have expressed their concerns over the contracts offered by MV Realty. For instance, Gievan Rodriguez shared his fears after signing a deal with MV Realty for $1,200. “I’m looking at a potential loss of the home,” Rodriguez lamented. His experience reflects a growing anxiety among those who unintentionally enter into these lengthy agreements.

Concerns Raised by Homeowners:

- Fear of Legal Action: Breaking the contract can lead to MV Realty suing for three percent of the home’s value.

- Loss of Equity: Homeowners like Vivian Lopez reported losing significant equity due to high termination fees.

The Attorney General’s Actions

In April, a Hillsborough County court heard testimonies regarding the adverse effects MV Realty’s practices have on homeowners. The Attorney General’s office has requested a temporary injunction against the company, arguing that MV Realty’s contracts harm consumers financially.

Statements from the Attorney General:

- Removal of Agreements: Spokesperson Kylie Mason stated that the motion requests the court to order MV Realty to eliminate homeowner agreements from public records.

- Public Harm: The documents filed emphasize the widespread detrimental impacts on homeowners across Florida.

MV Realty’s Defense

In response, MV Realty has denied the allegations. Their closing arguments insisted that:

- Transparency: MV Realty claims it provides clear disclosure regarding the homeowner agreements.

- Equity Access: The company facilitates loans to homeowners and does not charge fees for terminations, contesting the notion that they operate a deceptive scheme.

Defense Key Points:

- Claims of Facilitation: MV Realty argues that it assists homeowners in accessing their equity.

- Challenge to Allegations: According to MV Realty, the Attorney General’s claims of deception are unfounded.

Broader Implications

MV Realty has already filed for bankruptcy in South Florida, prompting concerns about its long-term viability amidst multiple lawsuits from various state attorneys general. This situation raises questions about the real estate practices of companies engaging with vulnerable homeowners looking for financial assistance.

Upcoming Developments

A trial date in Hillsborough County is expected to be set later this year, as this legal battle continues to unfold.

Conclusion

The ongoing legal issues surrounding MV Realty illuminate the critical need for transparency in real estate transactions. As homeowners navigate complex agreements, it’s essential to fully understand the long-term implications of their contracts.

For more information on the legal implications and real estate practices, visit Florida Attorney General’s Official Website or explore Consumer Financial Protection Bureau for further guidance.

Stay informed as this story continues to develop, and consider reviewing any contracts with a legal expert before signing.