Navigating the Florida Housing Market: Trends and Insights

Understanding Market Dynamics

As the Florida housing market evolves, new insights emerge that affect both buyers and investors. The recent trends indicate a significant price decline, particularly in Southwest Florida. Understanding these shifts is crucial for anyone involved in real estate, whether you’re a homeowner, investor, or industry professional.

The Current State of the Southwest Florida Market

Declining Home Prices

- April 2025 Sale Listing: A homeowner recently listed a property initially bought for $1,150,000 at a reduced price of $899,000 after multiple reductions.

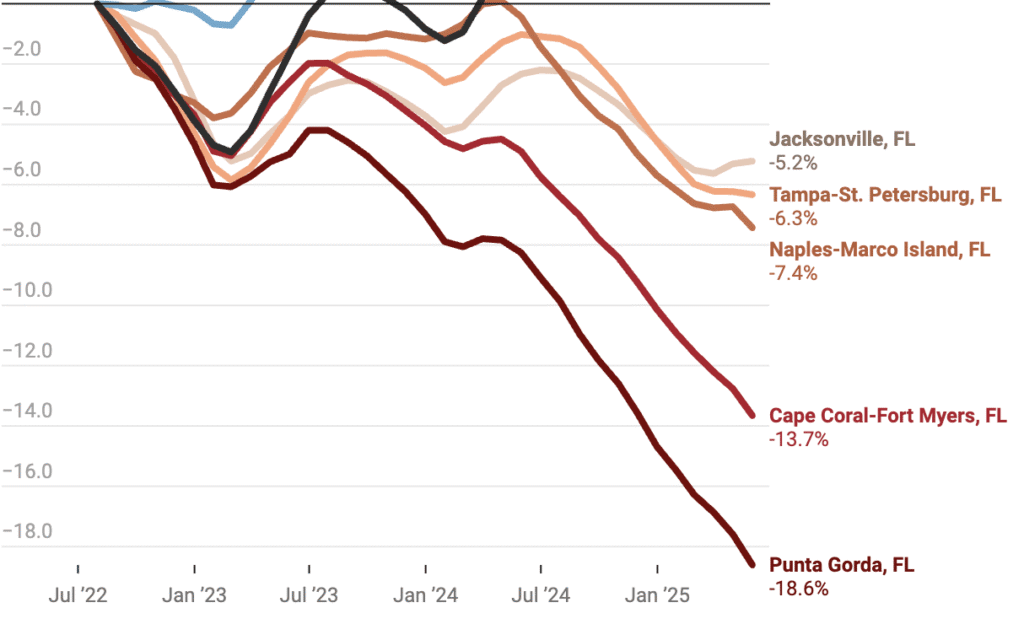

- Market Analysis: Despite the pending status of the listing, current analyses suggest the home may ultimately sell for 8.7% below its original purchase price. The Bank of America estimates a value of around $721,615, while ResiClub’s examination points to an 18.6% decline in home values across the Punta Gorda metro area since their peak in July 2022.

"In the grand scope of the housing sector, these reductions reflect broader market trends impacting investor decisions and buyer interest."

Comparisons with Other Markets

While the Austin metro area faces a 23% decline from its peak, it has not experienced the year-over-year price decreases that Southwest Florida is currently enduring. In Punta Gorda, single-family home prices are down 13.6%, whereas condo prices have decreased even further, by 20.4%.

Factors Influencing the Market

Vulnerability from Overheating

Florida’s housing market experienced a rapid surge during the pandemic, with prices climbing 51% from March 2020 to June 2022. This sharp increase has left it particularly vulnerable to market corrections.

Changing Buyer Dynamics

The recent cooling in Florida’s housing market correlates with a decline in domestic migration. Net migration fell from 314,000 in 2022 to 64,000 in 2024. This downturn means that local incomes have taken precedence in sustaining home prices, making affordability a bigger issue.

Impact of Hurricane Ian

Hurricane Ian, which struck in 2022, had a devastating impact on areas like Cape Coral and Punta Gorda. The aftermath resulted in thousands of homes needing repairs or renovations and increased supply in the market. Combined with rising mortgage rates and insurance premiums, these factors have contributed to the overall market softening.

Key Takeaways for Buyers and Investors

Essentials to Consider

- Monitor Listings: Active property listings are surpassing pre-pandemic levels, facilitating purchasing opportunities.

- Evaluate Unique Markets: Each neighborhood’s dynamics can vary, so a specialized focus is advisable.

- Budget for Insurance Costs: Understand the rising home insurance rates due to increased construction costs and hurricane risks which could influence your potential investments.

"As a potential buyer or investor, gauging the market’s current dynamics is essential to capitalize on the right opportunities."

The Future of Southwest Florida Real Estate

What Lies Ahead?

The question remains: have prices fallen enough to entice buyers back into the market? The ResiClub team is committed to further exploring this in upcoming reports.

Structural Changes

The recent Surfside condo disaster prompted new regulations enforcing safety inspections, which have substantially affected older coastal condo buildings, leading to increased HOA fees and special assessments. These financial burdens can create barriers forpotential condo buyers, further influencing market trends in the region.

New Construction Dynamics

Florida’s commitment to homebuilding amid affordability challenges presents a unique advantage. Builders have started implementing affordability measures, such as mortgage rate buydowns, which can ease buyer entry into the market. This increased inventory could potentially stabilize or even lower home prices by providing more options for buyers.

Conclusion: Staying Informed in a Shifting Landscape

The Florida housing market—especially in regions like Southwest Florida—presents a complex landscape with declining prices, shifting buyer demographics, and regulatory changes. For prospective buyers and investors, remaining informed and adaptable is crucial in this evolving environment.

Upcoming Events and Resources

To gain deeper insights, it’s beneficial to stay engaged with industry events and educational resources. Upcoming discussions, such as the ResiDay on November 7, 2025, will feature key housing market discussions relevant for stakeholders at all levels.

Additional Resources

- For detailed analyses on home prices and insurance trends, visit ResiClub PRO.

- Learn about tracking rental property finances effortlessly with Stessa, a powerful tool for real estate investors.

By understanding these trends and leveraging available resources, stakeholders can navigate the complexities of the Florida housing market effectively.