The Rise of Unsold Homes in Sun Belt’s Housing Market: What Buyers and Sellers Need to Know

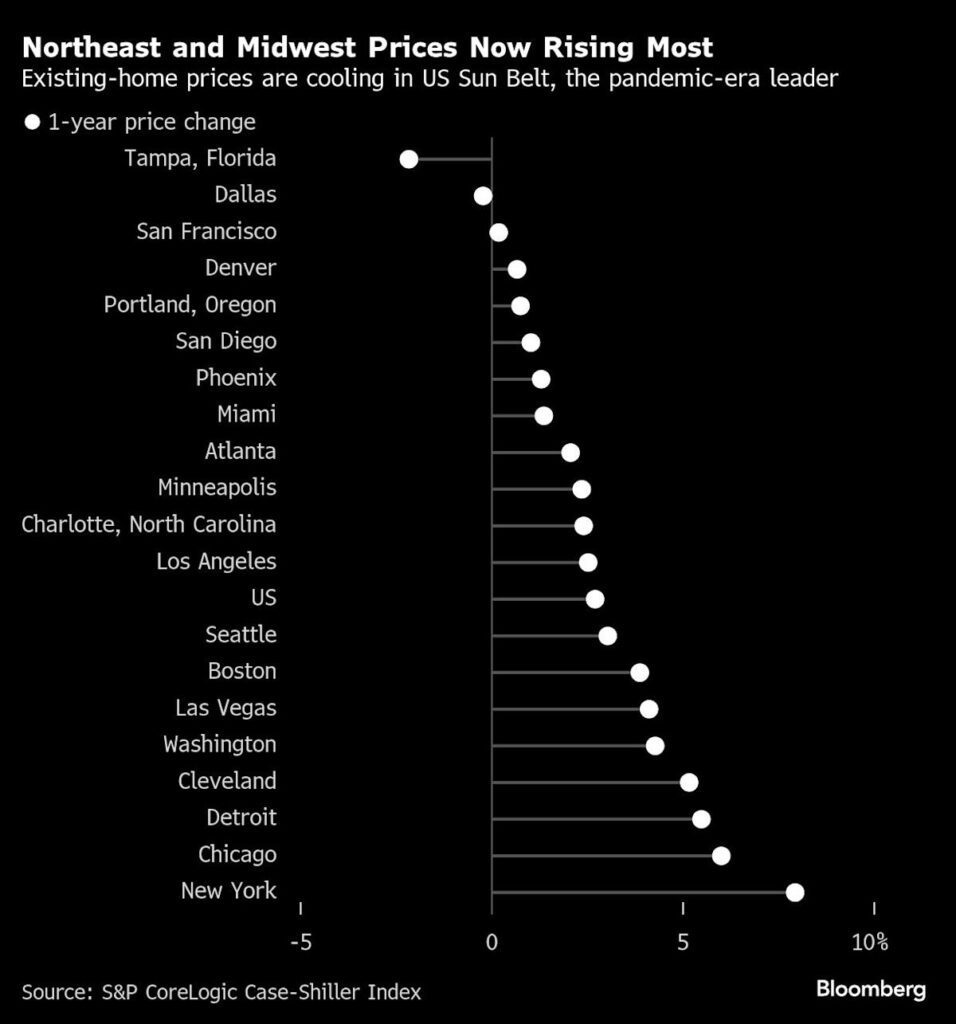

As the US housing market transitions from frenzy to moderation, several Sun Belt states are witnessing a significant inventory buildup of unsold homes. Markets that once experienced red-hot demand are now seeing houses sitting unsold for weeks, signaling what economists refer to as “normalization.” This shift is reshaping buying and selling dynamics, with important implications for homeowners, investors, and real estate professionals alike.

Increasing Home Supply in Sun Belt Markets: Causes and Trends

After years of historically low inventories, the balance between supply and demand is shifting in key southern and southwestern cities. Here’s what’s driving the rise in homes on the market:

- Seller Reluctance Eases: Many homeowners have previously held onto properties with locked-in low mortgage rates. But with 70% of US owners still paying below 5%, some are now giving up hope that rates (currently near 7%) will decline soon and are listing their homes.

- Rising Insurance Costs in Florida: High flood and homeowners insurance premiums are forcing some Florida residents to sell. For example, Tampa Bay brokers report a doubling of homes for sale in two years, with average selling times increasing from 55 to 73 days.

- Investors Exiting Rentals in Colorado: In Colorado, tenant-friendly laws are prompting investors to offload rental properties, boosting inventory by 110% over two years as per Realtor.com data.

- Builders Reducing Prices: Homebuilders who ramped up construction during the pandemic housing surge in the Sun Belt now face excess inventory and are offering discounts and concessions to entice buyers.

Economist Charlie Dougherty from Wells Fargo notes, “Inventories have been climbing, but they’ve been climbing out of a hole,” highlighting that supply remains below 2019 national levels even as some states surpass them.

What This Means for Homebuyers and Sellers

For Buyers

- More Options but Mixed Price Trends: While inventory grows, prices in some booming cities like Dallas and Tampa are starting to decline, offering new opportunities for buyers who had been previously priced out.

- Normalizing Market Conditions: The era of instant multiple offers is fading. Buyers can negotiate better deals as competition among sellers increases.

For Sellers

- Higher Competition: Sellers accustomed to quick sales face longer market times and the need to price homes competitively.

- Mortgage Rate Dilemma: Many hesitate to sell due to current high borrowing costs, which complicate buying new homes. Nevertheless, strong personal reasons such as relocation force some to list despite unfavorable rates.

Paul Epperley, president of the Fort Worth Realtors Association, observes, “They realize they’re not going to come back down to 2.8% in the foreseeable future,” reflecting owners’ acceptance of sustained higher mortgage rates.

The Role of Investors and Institutional Sellers

While much of the inventory increase comes from individual sellers, investor dynamics also influence the market:

- Mom-and-Pop Investors Selling Off: According to David Howard of the National Rental Home Council, many smaller investors are capitalizing on relatively favorable sales conditions to exit.

- Institutional Buyers Cautious: Larger firms are slowing purchases of single-family rental homes (SFRs) but aren’t yet offloading their portfolios en masse.

Local agents in cities like Atlanta, Dallas, and Phoenix report potential investor-driven inventory waves, though definitive data remains limited.

Regional Snapshots: Florida, Texas, and Colorado

- Florida: Homes in Florida’s Tampa Bay spend a median 73 days on the market—much longer than two years ago. Homeowners face surging insurance bills, prompting moves or sales.

- Texas: Fort Worth remains a seller’s market for now, but signs of distress show as owners throw in the towel on locking high mortgage rates.

- Colorado: Aggressive rental laws have spurred a 51% year-over-year inventory rise, one of the sharpest national surges.

What’s Next for the Sun Belt Housing Market?

The transition reflects a larger realignment after pandemic-fueled migration and supply crunches led to fierce bidding wars and record low inventories. Realtor.com’s market data confirms that while the national supply of existing homes has yet to fully recover, nine Sun Belt and Western states have surpassed pre-pandemic inventory levels.

For buyers, this signals a rare opportunity to explore markets with increasing choice and potential price relief. For sellers and investors, agility is crucial as market conditions no longer guarantee quick, high-price offers.

Key Takeaways for Home Market Participants

- Home sales are slowing, with days on market increasing notably in Sun Belt regions.

- Mortgage rates near 7% limit sellers’ willingness and ability to trade up, despite rising inventory.

- Drivers of growing supply include rising insurance costs, investor exit from rentals, and seller capitulation on high borrowing costs.

- Homebuilders are adjusting pricing strategies amid softening demand.

- Market normalization presents varying challenges and opportunities depending on locale.

This evolving landscape is reshaping what buyers and sellers can expect in the near future. For up-to-date insights, monitoring regional housing data and expert analysis from sources like the National Association of Realtors and S&P CoreLogic Case-Shiller Index is recommended.