The Luxury Real Estate Dilemma in South Florida: A Market Analysis

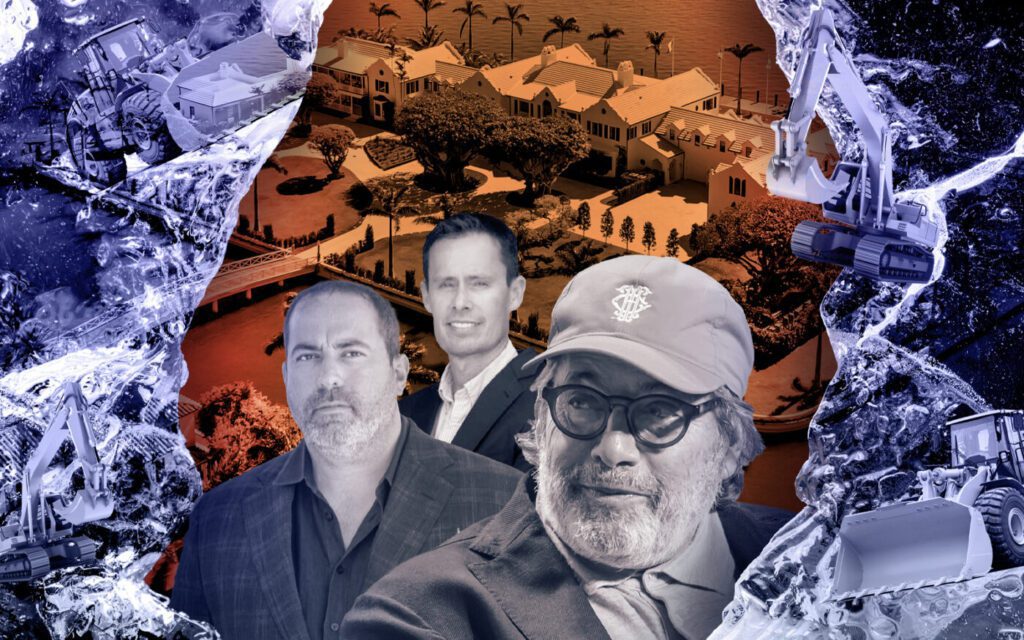

The luxury real estate market in South Florida is experiencing a paradox. Despite skyrocketing demand for high-end properties, many top developers, including renowned spec builder Todd Glaser, have hit the brakes on new constructions. This article explores the intricate dynamics affecting luxury residential development in the region.

An Overview of the Current Market Landscape

As South Florida’s luxury real estate scene flourishes, many affluent buyers are ready to invest. In fact, the last two years have seen:

- A sharp increase in demand for exclusive listings.

- A record-breaking sale of properties, including DJ David Guetta’s $69 million mansion and the $150 million sale of Tarpon Island in Palm Beach, facilitated by Glaser.

Yet, against this backdrop of wealth migration and escalating prices, Glaser made headlines by announcing, “I’m not building any new construction.”

Factors Behind the Halt in New Developments

While the demand for luxury homes is unprecedented, the constraints are primarily supply-side challenges, including:

-

Soaring Land Costs: Properties that once sold for $4 million have now reached $7 to $8 million.

[link-whisper-related-posts] -

Escalating Construction Costs: Developers are contending with costs that have doubled since the pandemic, reaching $1,500 per square foot for premium waterfront properties.

- Prolonged Development Timelines: A project that once took nine months could now extend to two years. Delays are often exacerbated by bureaucratic red tape in larger municipalities, affecting key stages like permitting.

Expert Insights on the Supply Dilemma

Matthew Martinez, president of Beacon Hill Property Group, describes the shift in construction as a “three-year process”, emphasizing that inefficiencies can turn minor delays into significant downturns:

“If you’re not on top of your job site on a daily basis, then you can see how a month delay becomes a two-month delay becomes a 12-month delay,” he noted.

Impact on Luxury Home Prices

The lack of new constructions is placing continuous upward pressure on existing luxury homes. As Dina Goldentayer, a leading agent at Douglas Elliman, outlines:

“They’re willing to pay a higher price than the neighbors to avoid the five-year process of building.”

This behavior demonstrates that time has become “a bigger currency” than money among ultra-high-net-worth individuals, as they seek immediate solutions rather than long-term development projects.

Quality Concerns: A Different Standard for Luxury

Affluent buyers from cities like New York and Los Angeles express a preference for quality that many spec developers struggle to meet. Goldentayer commented:

“Spec development is not what that buyer wants; that buyer wants a house built at an extremely high price per foot, with finishes that an end-user would pick.”

Top-tier builders like Glaser and Varas maintain that this quality disparity makes it imperative to focus not just on availability but also on the sophistication required for ultra-luxury projects.

Renovations as an Alternative

In light of these challenges, some developers are opting for renovations rather than new builds. Glaser has recently pivoted to this strategy, selling a renovated mansion for $38 million. He acknowledges that while it’s not the traditional route, it allows for quicker project completion and less bureaucratic hassle:

“It’s easier; we get to go a lot faster.”

Conclusion: The Future of Luxury Developments in South Florida

The South Florida luxury real estate market is at a crossroads, where rising demand meets significant barriers in supply. Here are the key takeaways:

-

Affluent Buyers Are Willing to Pay More: The desire to bypass lengthy building processes fuels current high prices.

-

Quality and Standards Matter: Developers must adapt to the unique expectations of high-net-worth clientele.

- Renovations Offer a Viable Solution: As new builds stall, renovations can fill the gap in the luxury market.

Developers like Todd Glaser may not be constructing new homes, but the demand for quality and immediate availability in the luxury market remains robust. For further insights into luxury real estate trends, consider visiting reputable industry resources such as Redfin or Douglas Elliman.